Wondering what "Ultimate Guide To Understanding And Verifying Mã Số Thuế Cá Nhân" is all about? Well, wonder no more! Ultimate Guide To Understanding And Verifying Mã Số Thuế Cá Nhân is a comprehensive resource that provides everything you need to know about understanding and verifying your Mã Số Thuế Cá Nhân (MSTCN).

Editor's Notes: Ultimate Guide To Understanding And Verifying Mã Số Thuế Cá Nhân have published today date, and this topic is important to read because it provides a wealth of information on a topic that is essential for Vietnamese citizens and taxpayers.

Our team has done the hard work of analyzing and gathering information, and we've put together this guide to help you make the right decision.

Key Differences or Key Takeaways:

Main Article Topics:

FAQ

This extensive guide provides comprehensive insights into understanding and verifying Mã Số Thuế Cá Nhân (MST), empowering individuals with the knowledge and tools necessary to ensure accuracy and compliance in their tax-related endeavors.

Question 1: What is the purpose of an MST?

An MST serves as a unique identifier for individuals in Vietnam's tax administration system. It facilitates effective tax management, streamlined tax collection, and enhances the overall efficiency of Vietnam's tax infrastructure.

Question 2: Who is eligible to obtain an MST?

Individuals who meet specific criteria, including Vietnamese citizens, foreign residents, and certain legal entities, are eligible to obtain an MST. Specific regulations and requirements vary depending on the individual's circumstances.

Question 3: How can I apply for an MST?

The application process for an MST can be initiated through various channels, including online portals, local tax offices, or designated registration agencies. Individuals are required to provide accurate personal information, supporting documentation, and adhere to established application procedures to ensure a successful registration.

Question 4: What are the potential consequences of not having an MST?

Individuals who fail to obtain an MST when required may face legal repercussions and penalties. These consequences can include fines, limitations on business operations, and potential legal complications during tax audits or interactions with tax authorities.

Question 5: How can I verify the authenticity of an MST?

Verifying the authenticity of an MST is crucial to ensure its validity and prevent potential fraudulent activities. This can be done through official government portals or designated verification services that allow individuals to confirm the existence and status of an MST in the tax administration system.

Question 6: What are the best practices for managing an MST?

Responsible management of an MST involves maintaining accurate and up-to-date information, promptly reporting any changes or discrepancies, and adhering to established tax regulations. Individuals should also exercise caution when sharing their MST to prevent unauthorized access or misuse.

![]()

Máy đục lỗ CNC - Source goldsuncnc.vn

In summary, understanding and verifying Mã Số Thuế Cá Nhân is essential for ensuring compliance, avoiding legal complications, and facilitating efficient tax administration. By adhering to established procedures, maintaining accurate records, and utilizing available resources, individuals can effectively manage their MST and fulfill their tax obligations.

To delve deeper into the intricacies of MST management, explore the following article section for additional insights and best practices.

Tips

For a more in-depth understanding and verification of Ultimate Guide To Understanding And Verifying Mã Số Thuế Cá Nhân, consider the following tips:

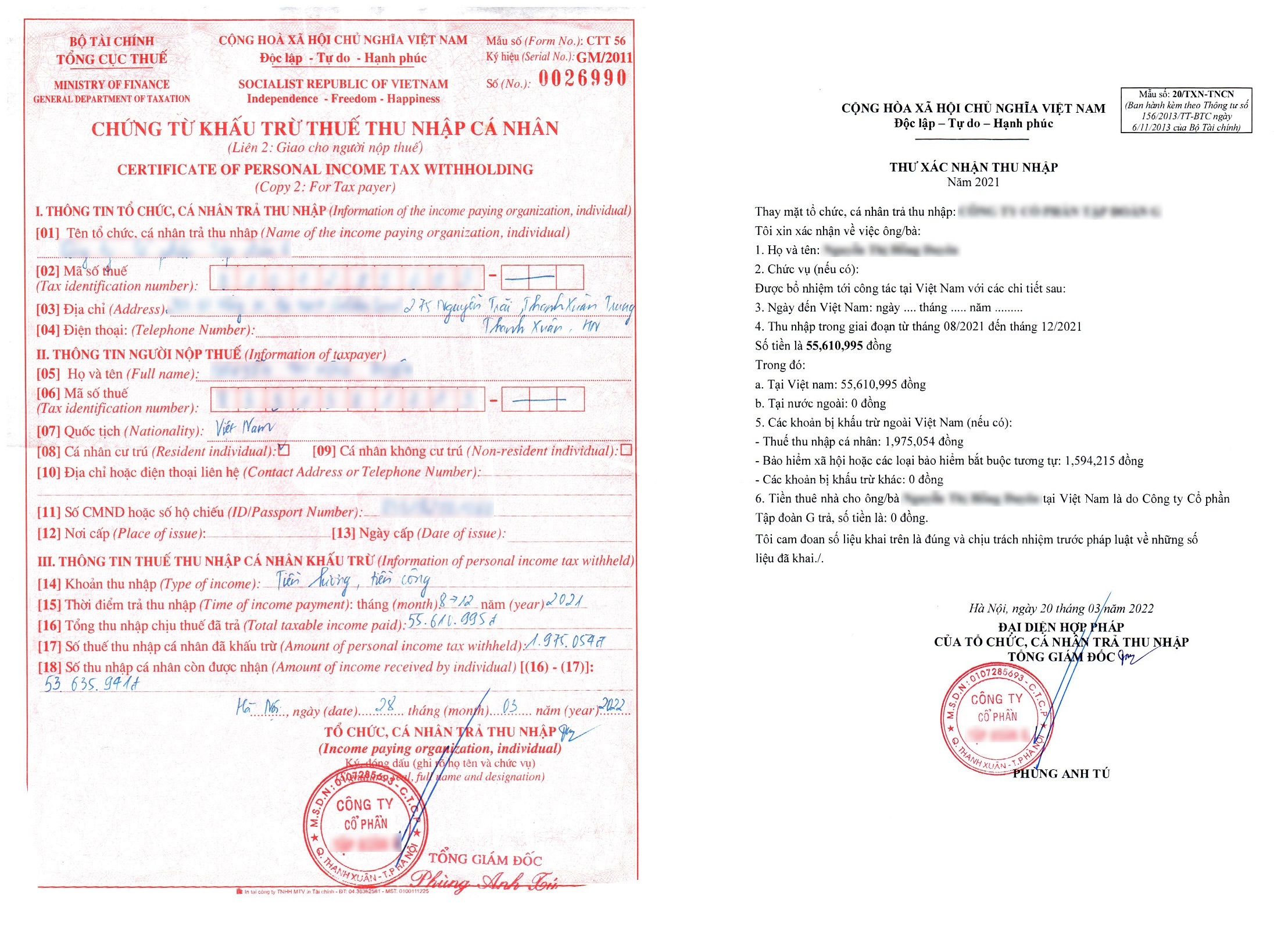

Tip 1: Check for the correct format. The Mã Số Thuế Cá Nhân (MST) is a 10-digit code that follows a specific format: 00-0000000-0. This format indicates the type of taxpayer (00), the province or city where the tax registration was made (00000), and the individual taxpayer's identification number (000).

Tip 2: Verify the taxpayer information. The information associated with the MST should match the taxpayer's personal details, such as their full name, date of birth, and address. This information can be cross-checked with official documents like the taxpayer's passport or identity card.

Tip 3: Check the validity period. The MST has a validity period that is usually indicated on the tax registration certificate. Ensure that the certificate is valid for the current tax year and has not expired.

Tip 4: Use online verification tools. Some tax authorities provide online verification tools that allow you to check the validity of an MST. These tools may require you to enter the MST and other personal information to confirm its authenticity.

Tip 5: Contact the tax authorities. If you are unable to verify the MST yourself, you can contact the relevant tax authorities. They can provide you with additional information and assist in verifying the MST's validity.

By following these tips, you can ensure that you have a valid and up-to-date MST, which is essential for fulfilling tax obligations and avoiding potential legal issues.

Remember, it is always advisable to consult reliable sources and seek professional advice if needed for comprehensive understanding and accurate verification of tax-related matters.

Ultimate Guide To Understanding And Verifying Mã Số Thuế Cá Nhân

A Mã Số Thuế Cá Nhân (MSTCN), or individual tax code, is a unique identifier assigned to every taxpayer in Vietnam. It is essential for various tax-related purposes, including filing tax returns, paying taxes, and claiming tax refunds. This guide provides an in-depth understanding of MSTCNs, including their structure, verification methods, and importance in the Vietnamese tax system.

Hướng dẫn đơn giản để hiểu số lượng đặt hàng tối thiểu (MOQ) trong bán - Source bestprint.vn

- Structure: Understanding the format and components of an MSTCN

- Verification: Methods to verify the authenticity and validity of a MSTCN

- Importance: Essential role in tax administration and compliance

- Obligations: Responsibilities of taxpayers related to MSTCNs

- Rights: Taxpayers' rights in relation to MSTCNs

- Consequences: Potential implications of having an incorrect or invalid MSTCN

By understanding these key aspects, taxpayers can ensure compliance with Vietnamese tax regulations, avoid penalties, and effectively manage their tax obligations. Additionally, MSTCNs facilitate efficient tax administration, promote transparency, and contribute to the overall development of the Vietnamese tax system.

Dịch vụ hỗ trợ thủ tục hoàn thuế TNCN - Source azlaw.vn

Ultimate Guide To Understanding And Verifying Mã Số Thuế Cá Nhân

The Ultimate Guide To Understanding And Verifying Mã Số Thuế Cá Nhân provides a comprehensive overview of this essential identification number used in Vietnam for various administrative and financial purposes. This guide plays a crucial role in ensuring the accuracy and validity of the Mã Số Thuế Cá Nhân, which is indispensable for individuals to fulfill their tax obligations, access essential services, and engage in financial transactions in the country.

Tìm hiểu cách tăng doanh số | Học viện TikTok Shop | Việt Nam - Source seller-vn.tiktok.com

Understanding and verifying the Mã Số Thuế Cá Nhân is of paramount importance because it serves as a unique identifier for individuals in Vietnam. It is essential for various official processes, including tax filings, opening bank accounts, registering vehicles, and completing other administrative procedures. By providing a comprehensive guide to understanding and verifying the Mã Số Thuế Cá Nhân, this document empowers individuals to navigate the complexities of Vietnam's administrative and financial systems with confidence.

This guide offers practical advice and step-by-step instructions on how to verify the validity of the Mã Số Thuế Cá Nhân, including online and offline methods. It also includes real-life examples and case studies to illustrate the importance of accurate and verified Mã Số Thuế Cá Nhân in various real-world scenarios.

Conclusion

The Ultimate Guide To Understanding And Verifying Mã Số Thuế Cá Nhân provides a valuable resource for individuals in Vietnam to fully understand and effectively manage their Mã Số Thuế Cá Nhân. By following the guidance outlined in this comprehensive document, individuals can ensure the accuracy and validity of their Mã Số Thuế Cá Nhân, enabling them to seamlessly navigate various administrative and financial processes in the country.

As Vietnam continues to modernize and integrate with the global economy, the importance of a reliable and verifiable Mã Số Thuế Cá Nhân will only increase. This guide serves as a vital tool to empower individuals to actively participate in the country's economic and social development.