Maximize Your Social Security Benefits: A Comprehensive Guide to Claiming and Optimizing Payments.

Maximize Your Social Security Benefits: A Comprehensive Guide to Claiming and Optimizing Payments is a must-have resource for navigating the complexities of the Social Security system. This guide provides comprehensive insights into maximizing your benefits and securing your financial future.

Through meticulous analysis and detailed explanations, this guide empowers you to make informed decisions regarding your benefits. It covers a wide range of topics, including claiming strategies, maximizing your earnings record, and optimizing your income streams.

Key differences or Key takeways

Transition to main article topics

FAQ

The following frequently asked questions (FAQs) are designed to provide a concise overview of the information provided in this comprehensive guide to claiming and optimizing Social Security benefits.

Question 1: When should I start claiming Social Security benefits?

The optimal claiming age depends on various factors, including life expectancy, health status, and financial needs. Generally, claiming at age 62 results in lower monthly payments, while delaying claiming until age 70 or later leads to higher payments.

Question 2: Can I work while receiving Social Security benefits?

Yes, but there are earnings limits that must be considered. In 2023, the limit for those under full retirement age is $21,240, and for those at or above full retirement age, it is $56,520. Exceeding these limits can result in a reduction of benefits.

Question 3: What if I have multiple income sources?

Social Security benefits may be taxable if combined with other income sources, such as wages, pensions, or investment income. It is important to consult with a tax professional to understand the potential tax implications.

Question 4: Can I transfer Social Security credits between spouses?

Yes, in certain situations. If one spouse has little or no Social Security earnings, they may be able to claim a spousal benefit based on the earnings of their spouse. However, eligibility and benefit amounts are subject to specific requirements.

Question 5: What is the difference between SSI and SSDI?

Supplemental Security Income (SSI) is a needs-based program that provides financial assistance to low-income individuals who are blind, disabled, or over the age of 65. Social Security Disability Insurance (SSDI) provides benefits to individuals who are disabled and have a sufficient work history.

Question 6: What resources are available for assistance with Social Security benefits?

The Social Security Administration (SSA) provides a wealth of resources, including online information, publications, and local field offices. Additionally, there are numerous non-profit organizations that offer free or low-cost assistance with Social Security matters.

Understanding these key aspects of Social Security benefits is crucial for maximizing potential retirement income. By carefully considering these factors and utilizing the available resources, individuals can optimize their Social Security benefits and plan for a secure financial future.

How should I move my Social Security Direct Deposit to Old Glory Bank? - Source help.oldglorybank.com

Next Article Section: Maximizing Your Social Security Benefits: Strategies and Considerations

Tips

Understanding the complex rules and regulations surrounding Social Security benefits can be challenging. By implementing the following tips, you can increase your understanding and potentially maximize your benefits.

Tip 1: Understand Your Full Retirement Age and Filing Options

Your Full Retirement Age (FRA) is the age at which you are eligible to receive full Social Security retirement benefits. Filing for benefits before your FRA will result in reduced payments, while delaying past your FRA will increase your monthly amount. Consider your financial situation and life expectancy when making this decision.

Tip 2: Explore Spousal and Survivor Benefits

If you are married or have a surviving spouse, you may be eligible for spousal or survivor benefits. These benefits can provide a significant income boost and should be considered in your planning.

Tip 3: Maximize Earnings in Peak Years

Your Social Security benefits are based on your highest 35 years of earnings. By maximizing your earnings in your peak earning years, you can significantly increase your benefit amount.

Tip 4: Utilize the Delayed Retirement Credit

If you delay claiming benefits past your FRA, you will receive a delayed retirement credit that increases your monthly payment by 8% per year up to age 70. This strategy can be beneficial if you can afford to delay receiving benefits.

Tip 5: Manage Your Assets and Income Sources

Your Social Security benefits may be subject to taxation if your income exceeds certain thresholds. By managing your assets and income sources, you can minimize the potential impact of taxes on your benefits.

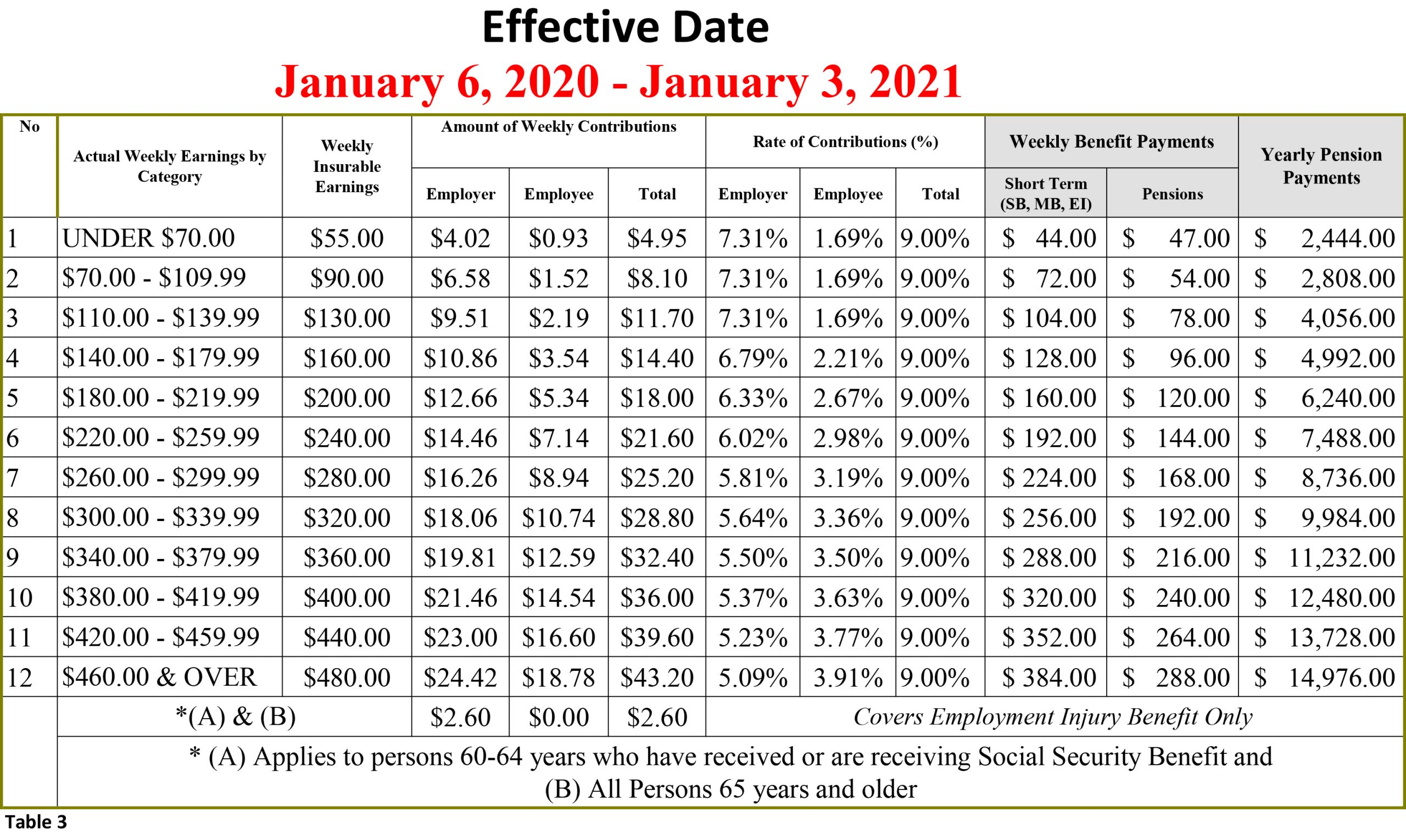

Social Security Benefits 2025 Increase Charts - Babara K. Pero - Source babarakpero.pages.dev

Maximize Your Social Security Benefits: A Comprehensive Guide To Claiming And Optimizing Payments

Maximizing Social Security benefits requires careful planning and understanding. Key aspects to consider include establishing full retirement age, understanding earning limits, optimizing spousal benefits, utilizing delayed retirement credits, exploring survivor benefits, and considering windfall elimination provisions.

- Full Retirement Age: Age at which full benefits can be claimed without penalty.

- Earning Limits: Working while receiving benefits may impact payments.

- Spousal Benefits: Spouses may be eligible for benefits based on their partner's earnings record.

- Delayed Retirement Credits: Benefits increase for each month claimed after full retirement age.

- Survivor Benefits: Surviving spouses or dependents may be eligible for benefits based on the deceased's earnings record.

- Windfall Elimination Provisions: Certain non-covered employment may reduce benefits.

For instance, delaying claiming benefits until age 70 can result in significantly higher monthly payments. Couples may optimize benefits by coordinating their claiming strategies. Understanding earning limits helps avoid benefit reductions while working. By considering these aspects and seeking professional guidance if needed, individuals can maximize their Social Security benefits and ensure financial security during retirement and beyond.

How to Maximize Your Social Security Benefits | Savvy - Source www.savvywealth.com

Maximize Your Social Security Benefits: A Comprehensive Guide To Claiming And Optimizing Payments

"Maximize Your Social Security Benefits: A Comprehensive Guide To Claiming And Optimizing Payments" is an invaluable resource for individuals seeking to maximize their Social Security benefits. This guide provides comprehensive information on how to claim and optimize Social Security benefits, ensuring that individuals receive the full amount they are entitled to. It covers a wide range of topics, including eligibility requirements, benefit calculations, claiming strategies, and maximizing retirement income.

Maximize Your Social – a Social Media Podcast - Source maximizeyoursocial.com

Understanding the connection between "Maximize Your Social Security Benefits: A Comprehensive Guide To Claiming And Optimizing Payments" and its significance as a component of retirement planning is crucial. Social Security benefits play a vital role in providing financial security during retirement, and optimizing these benefits can significantly enhance an individual's retirement income. The guide offers valuable insights into the complexities of Social Security regulations, empowering individuals to make informed decisions about their benefits.

The practical significance of this understanding is evident in the potential financial gain individuals can achieve by optimizing their Social Security benefits. By following the strategies outlined in the guide, individuals can increase their monthly benefit payments, reduce taxes on their benefits, and maximize their overall retirement income. The guide also provides guidance on how to coordinate Social Security benefits with other retirement income sources, such as pensions and investments, to create a comprehensive retirement financial plan.

Key Insights

- Understanding Social Security regulations is essential for maximizing benefits.

- Optimizing Social Security benefits can significantly enhance retirement income.

- The guide provides practical strategies for claiming and optimizing Social Security benefits.

- Coordinating Social Security benefits with other retirement income sources is crucial for financial security.

Conclusion

"Maximize Your Social Security Benefits: A Comprehensive Guide To Claiming And Optimizing Payments" is a valuable resource that empowers individuals to maximize their Social Security benefits and achieve financial security in retirement. By understanding the connection between this guide and the importance of optimizing Social Security benefits, individuals can make informed decisions and take proactive steps to secure their financial future.

The guide serves as a comprehensive roadmap for navigating the complexities of Social Security regulations and maximizing retirement income. It provides practical strategies, real-life examples, and expert insights that can help individuals make the most of their Social Security benefits. By investing in this guide, individuals can gain the knowledge and confidence needed to optimize their Social Security benefits and secure a more financially secure retirement.