Unlocking The Value Of BP: A Comprehensive Analysis For Investors - This report aims to furnish investors with all the critical information needed for a sound evaluation of BP's intrinsic value.

Unlocking The Customer Value Chain - Source ericjacobsononmanagement.blogspot.com

Editor's Notes: Unlocking The Value Of BP: A Comprehensive Analysis For Investors" have published today date". Given the recent market volatility and the uncertain economic outlook, it is more important than ever for investors to have access to high quality, objective research. This report is designed to provide investors with the insights and analysis they need to make informed investment decisions.

Our team of analysts has conducted extensive research and analysis on BP, including a review of the company's financial statements, earnings calls, and industry reports. We have also spoken with management and industry experts to get their insights on the company's prospects.

Key differences or Key takeaways

FAQ

This section addresses frequently asked questions (FAQs) concerning the analysis of British Petroleum (BP) for investment purposes.

Unlocking Insights: A Comprehensive Guide To Power Maps - Australia - Source australiarainmap.pages.dev

Question 1: What are the key financial metrics for evaluating BP's performance?

Answer: Key financial metrics for BP include revenue, earnings per share (EPS), operating cash flow, debt-to-equity ratio, and return on invested capital (ROIC).

Question 2: How does BP compare to its peers in the oil and gas industry?

Answer: BP's financial performance, market share, and competitive advantages relative to industry peers provide insight into its market position.

Question 3: What factors could impact BP's future financial performance?

Answer: Factors influencing BP's future performance include oil and gas prices, exploration and production costs, regulatory changes, and technological advancements.

Question 4: What are the potential risks associated with investing in BP?

Answer: Investment risks related to BP include commodity price volatility, environmental liabilities, operational risks, and geopolitical uncertainties.

Question 5: How can investors assess the sustainability and ESG practices of BP?

Answer: Investors can evaluate BP's sustainability and ESG practices through metrics such as carbon emissions, renewable energy investment, and social responsibility initiatives.

Question 6: What are the investment recommendations and potential returns for BP?

Answer: Investment recommendations, considering factors such as financial performance, competitive landscape, risks, and potential returns, provide guidance for making informed decisions.

By addressing these FAQs, investors can gain a deeper understanding of the key factors to consider when evaluating BP for investment purposes.

Continue to the next section to discover insights into BP's industry outlook and competitive analysis.

Tips

Why invest in bp | Investors | Home - Source www.bp.com

BP can benefit investors in various ways, including income generation, diversification, growth opportunities, and access to energy and infrastructure assets.

Tip 1: Understand BP's Business Strategy

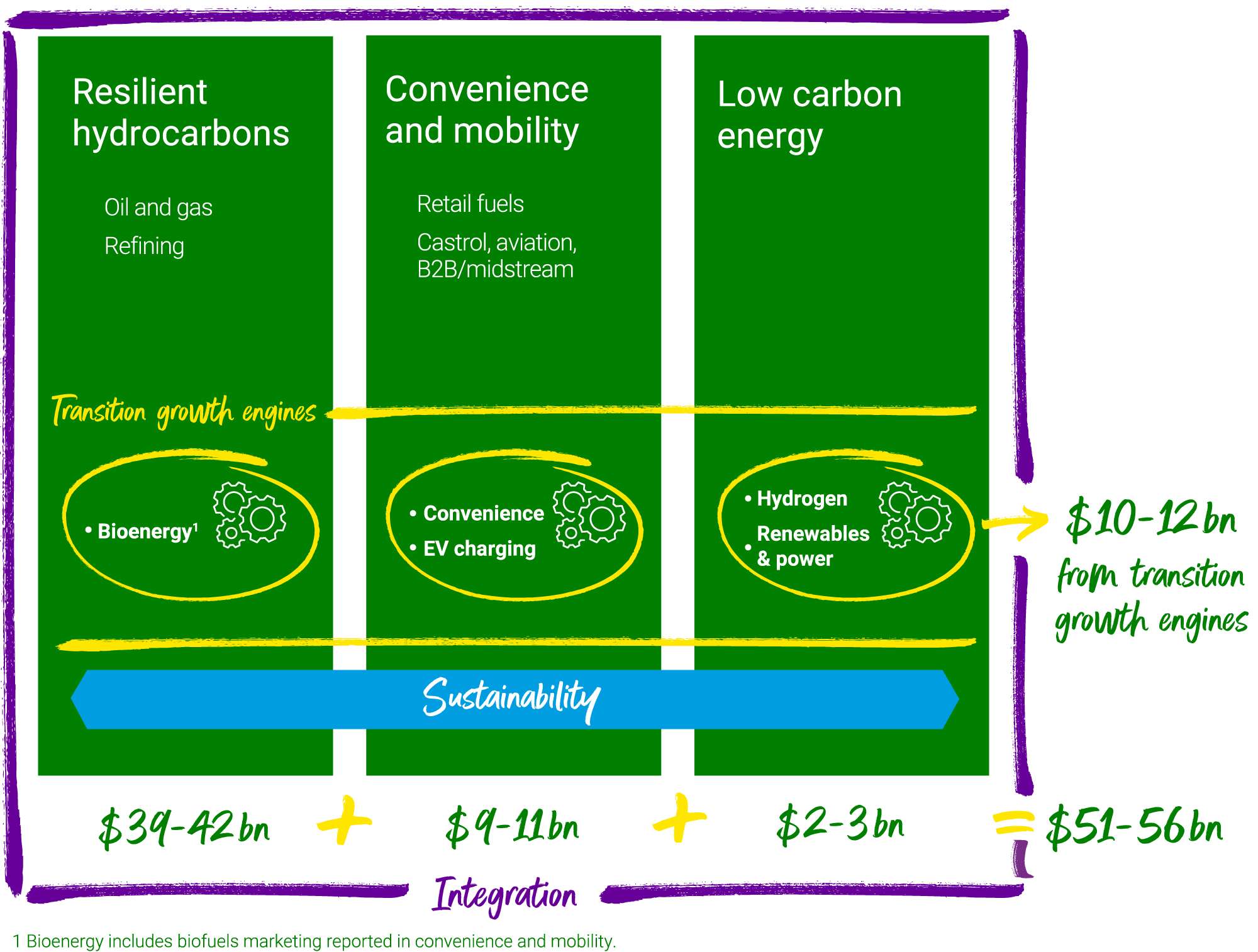

BP's focus on transitioning to a lower-carbon future, optimizing its portfolio, and increasing efficiency makes it an attractive investment for those seeking long-term growth in the energy sector.

Tip 2: Analyze Financial Performance

BP's strong financial track record, including consistent dividend payments and positive cash flow, indicates its financial stability and ability to deliver value to investors.

Tip 3: Consider ESG Factors

BP's commitment to environmental, social, and governance (ESG) principles aligns with ESG-conscious investors' goals and can enhance portfolio resilience.

Tip 4: Evaluate Industry Trends

The energy industry is constantly evolving. Keeping abreast of industry trends and understanding BP's position within the sector can help investors make informed decisions.

Tip 5: Conduct Due Diligence

Thorough due diligence, including a review of company filings, financial statements, and expert opinions, is essential before making an investment decision.

By following these tips, investors can develop a comprehensive understanding of BP and make informed decisions that align with their investment objectives. Unlocking The Value Of BP: A Comprehensive Analysis For Investors can provide further insights.

In conclusion, investing in BP offers potential benefits such as income generation, diversification, growth opportunities, and exposure to the energy and infrastructure sectors. By considering the tips outlined above, investors can maximize their understanding of BP and make informed investment decisions.

Unlocking The Value Of BP: A Comprehensive Analysis For Investors

BP, a global energy company, presents investors with opportunities to unlock significant value. This comprehensive analysis delves into six essential aspects that shape the company's value proposition, offering insights for informed investment decisions.

- Operational Efficiency: BP's focus on streamlining operations and reducing costs enhances profitability.

- Diversified Portfolio: The company's balanced mix of oil, gas, and renewable energy assets provides resilience against market fluctuations.

- Technological Innovation: BP's investment in cutting-edge technologies drives growth and positions it as an industry leader.

- Strategic Partnerships: Key partnerships with companies like Rosneft and Sinopec expand BP's reach and access to new markets.

- Climate Change Preparedness: BP's commitment to reducing carbon emissions and embracing sustainability aligns with investor concerns.

- Dividend Yield: BP's attractive dividend yield offers investors a steady stream of income.

bp completes integrated gas value chain in China with delivery of LNG - Source www.bp.com

These aspects collectively contribute to BP's long-term value proposition. Operational efficiency and a diversified portfolio provide a solid financial foundation, while technological innovation and strategic partnerships drive growth. Climate change preparedness demonstrates BP's adaptability to evolving market demands, and a competitive dividend yield enhances the overall investment appeal. Understanding these key aspects empowers investors to make informed decisions and unlock the full potential of their BP investments.

Unlocking The Value Of BP: A Comprehensive Analysis For Investors

The report titled "Unlocking The Value Of BP: A Comprehensive Analysis For Investors" provides a comprehensive overview of BP's financial performance, strategic initiatives, and future prospects. The analysis is based on a thorough examination of BP's financial statements, industry reports, and expert insights.

ESG Reporting: Unlocking Value Creation Beyond Compliance - Source www.wireconsultants.com

The report highlights the key drivers of BP's value creation, including its strong operational performance, disciplined cost management, and commitment to low-carbon energy. The analysis also identifies potential risks and challenges that BP may face in the future, such as volatile oil prices, geopolitical uncertainty, and the transition to a low-carbon economy.

The report concludes that BP is a well-positioned company with a strong track record of value creation. The company's financial performance is expected to remain strong in the coming years, supported by its operational excellence, disciplined cost management, and commitment to low-carbon energy.

However, the report also cautions that BP faces a number of challenges, including volatile oil prices, geopolitical uncertainty, and the transition to a low-carbon economy. These challenges could impact BP's financial performance in the future. However, BP's strong financial position and commitment to innovation should allow it to navigate these challenges and continue to create value for investors.