Navigating the complex world of student loans is crucial for students and families seeking higher education. Student Loans: Navigating Financing, Repayment, And Loan Forgiveness Options For Higher Education provides comprehensive guidance through this financial maze.

Editor's Notes: "Student Loans: Navigating Financing, Repayment, And Loan Forgiveness Options For Higher Education" has published today date". Understanding these options empowers individuals to make informed decisions about financing their education and managing their student loan debt.

Through extensive analysis and research, we have compiled this guide to provide a clear understanding of the available financing options, repayment plans, and loan forgiveness programs. Our goal is to help individuals navigate the complexities of student loans with confidence and make the best choices for their future.

This guide provides valuable insights into:

- Types of student loans and their key differences

- Repayment plans and strategies to reduce monthly payments and interest charges

- Loan forgiveness programs and eligibility criteria

- Tips for managing student loan debt effectively

- Resources and support available to student loan borrowers

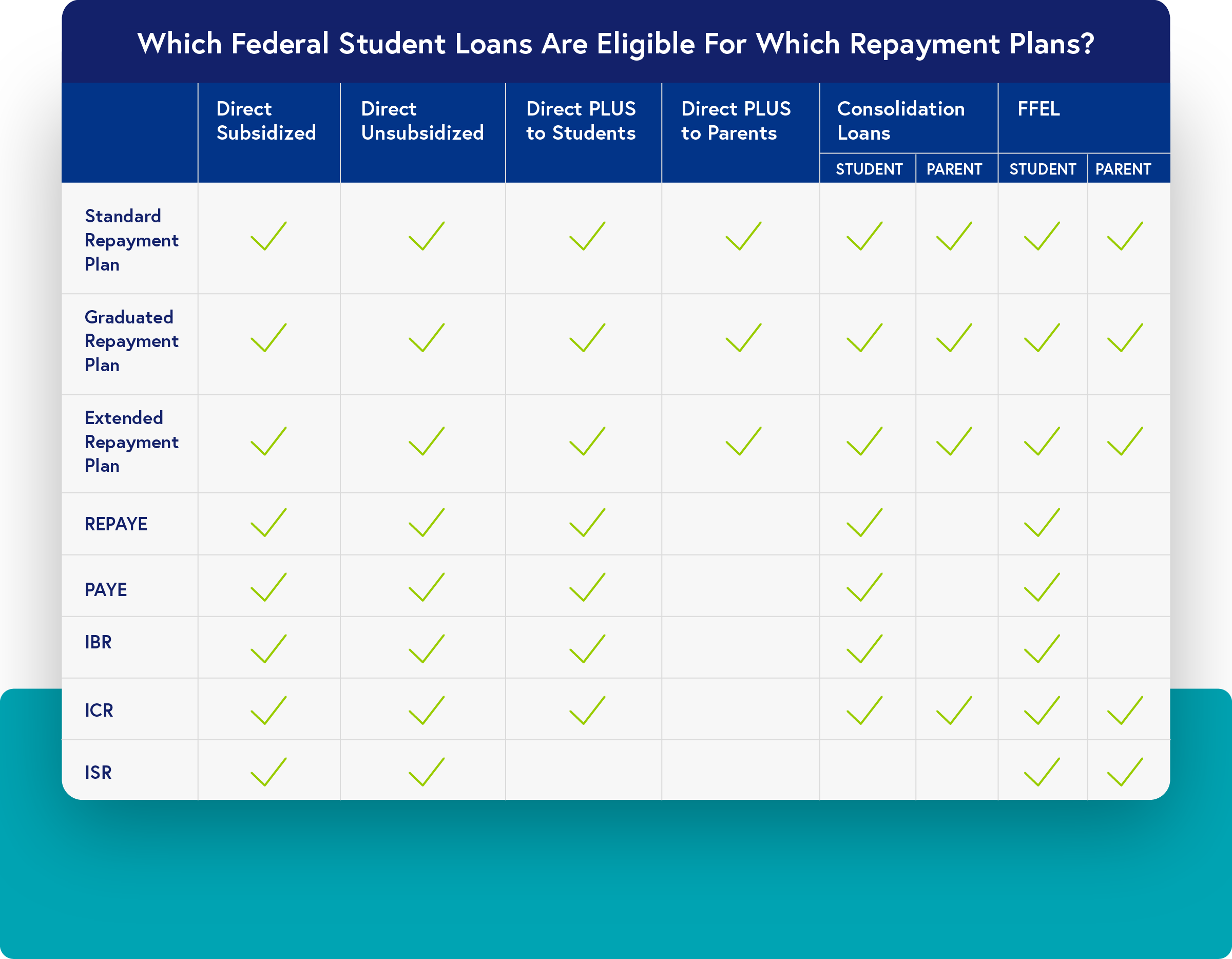

Student Loan Repayment Plan Options | College Ave - Source www.collegeavestudentloans.com

By equipping individuals with this knowledge, we aim to empower them to make informed decisions about their education financing and achieve their academic and career goals without the burden of overwhelming student loan debt.

FAQ

Seeking financial assistance for higher education can be daunting, leaving many with unanswered questions about student loans. This FAQ aims to provide clear and comprehensive information to navigate the complexities of financing, repayment, and loan forgiveness options.

Question 1: What are the different types of student loans available?

Student loans fall into two main categories: federal and private. Federal loans are offered by the government and come with various benefits, including low interest rates, flexible repayment options, and potential for loan forgiveness. Private loans are offered by banks and other financial institutions, and typically have higher interest rates and less favorable terms.

Follow these three steps to make sure you’re on the federal student - Source www.pinterest.com

Question 2: How do I determine how much I can borrow?

The amount you can borrow depends on factors such as your income, expenses, and the cost of your education. Federal loans have annual and aggregate loan limits, while private loans may have more flexible lending criteria.

Question 3: What are the different repayment options available?

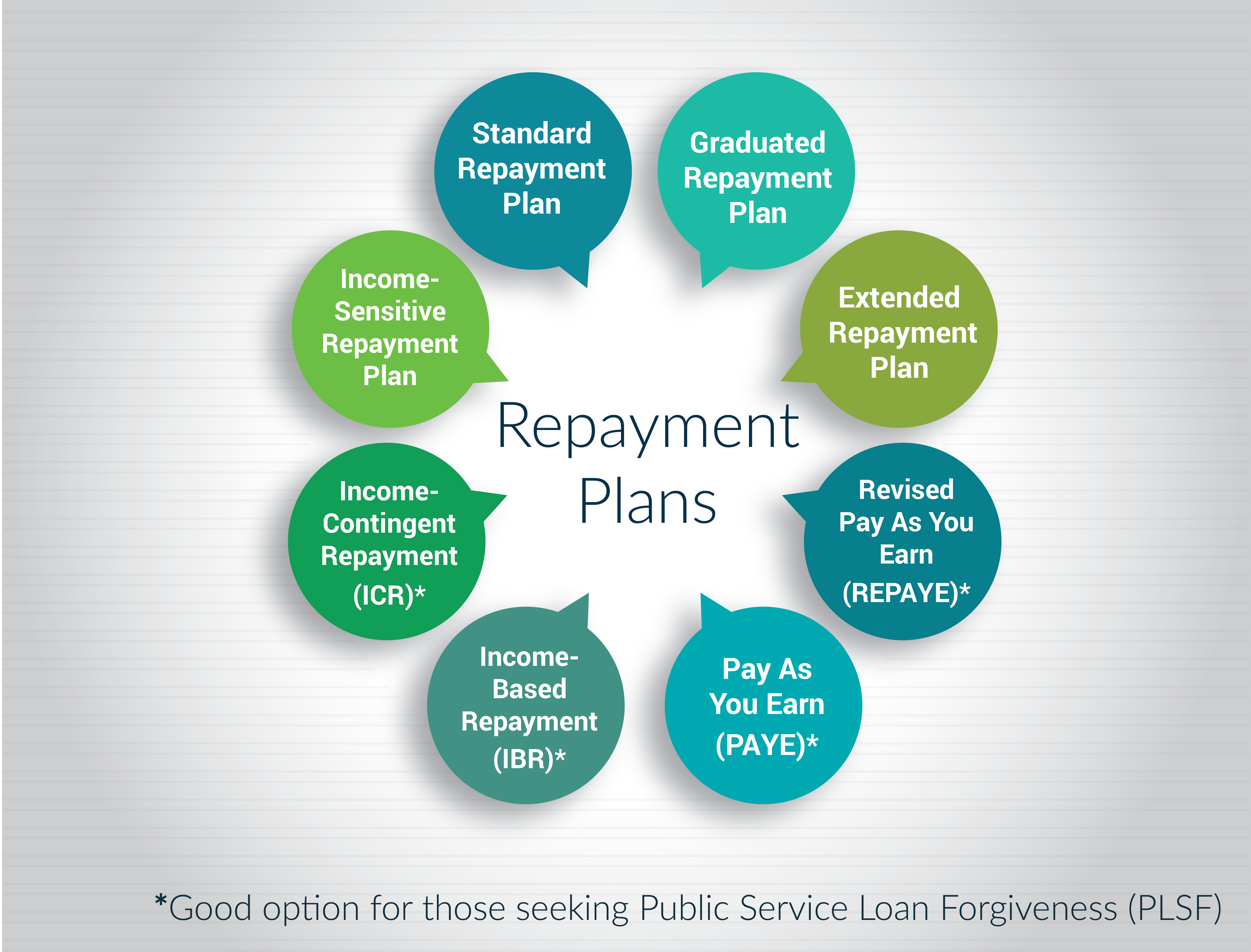

Federal loans offer various repayment plans, including income-driven options that adjust your monthly payments based on your income. Private loans typically have fewer repayment options. It's crucial to choose a plan that aligns with your financial situation and long-term goals.

Question 4: What is loan forgiveness?

Loan forgiveness programs allow borrowers to have their federal student loans discharged under certain conditions. These programs include Public Service Loan Forgiveness, Teacher Loan Forgiveness, and Perkins Loan Cancellation. Eligibility requirements and application processes vary.

Question 5: How can I manage my student loans effectively?

Effective student loan management involves budgeting, making regular payments, and exploring options to reduce interest and principal. Consider consolidating or refinancing your loans to potentially lower your monthly payments.

Question 6: What resources are available to help me with student loans?

Various resources are available to assist borrowers, including the Federal Student Aid website, the National Student Loan Data System, and non-profit credit counseling agencies. These resources provide information, support, and guidance to help you navigate the complexities of student loans.

Navigating student loans can be challenging, but understanding your options and making informed decisions can significantly improve your financial well-being. By seeking professional advice, exploring available resources, and diligently managing your loans, you can effectively finance your education and pursue your career aspirations.

Transition to the next article section:

Tips

Managing student loans effectively requires careful planning.

Navigating the Canada Emergency Business Account (CEBA) Repayment and - Source www.gba-llp.ca

Tip 1: Understand Loan Options Thoroughly

Research federal and private student loans, comparing interest rates, repayment terms, and eligibility criteria. Determine the most suitable loan type based on specific financial circumstances.

Tip 2: Borrow Responsibly

Consider future earning potential and expenses when determining the amount of student debt to take on. Avoid borrowing more than necessary to cover essential education expenses.

Tip 3: Explore Repayment Options

Learn about different repayment plans, such as income-driven or extended repayment. Consider loan consolidation or refinancing to potentially reduce interest rates or monthly payments.

Tip 4: Take Advantage of Loan Forgiveness Programs

Explore loan forgiveness options, like Public Service Loan Forgiveness or teacher loan forgiveness. Meet eligibility requirements and submit necessary paperwork to qualify for potential debt cancellation.

Tip 5: Seek Professional Guidance if Needed

Consider consulting with a financial advisor or loan counselor for personalized advice. They can assist with loan management strategies and help navigate complex repayment or loan forgiveness processes.

By following these tips, individuals can navigate student loans effectively, manage debt responsibly, and explore options for loan forgiveness.

For further information, refer to the comprehensive guide: Student Loans: Navigating Financing, Repayment, And Loan Forgiveness Options For Higher Education.

Student Loans: Navigating Financing, Repayment, And Loan Forgiveness Options For Higher Education

Student loans play a significant role in financing higher education, and understanding the intricacies of financing, repayment, and forgiveness options is crucial. This article highlights six key aspects to consider when navigating these options.

- Loan Types: Understand the differences between federal and private loans, subsidized and unsubsidized loans, and their implications.

- Interest Rates: Compare interest rates offered by different lenders and consider the impact of variable versus fixed rates.

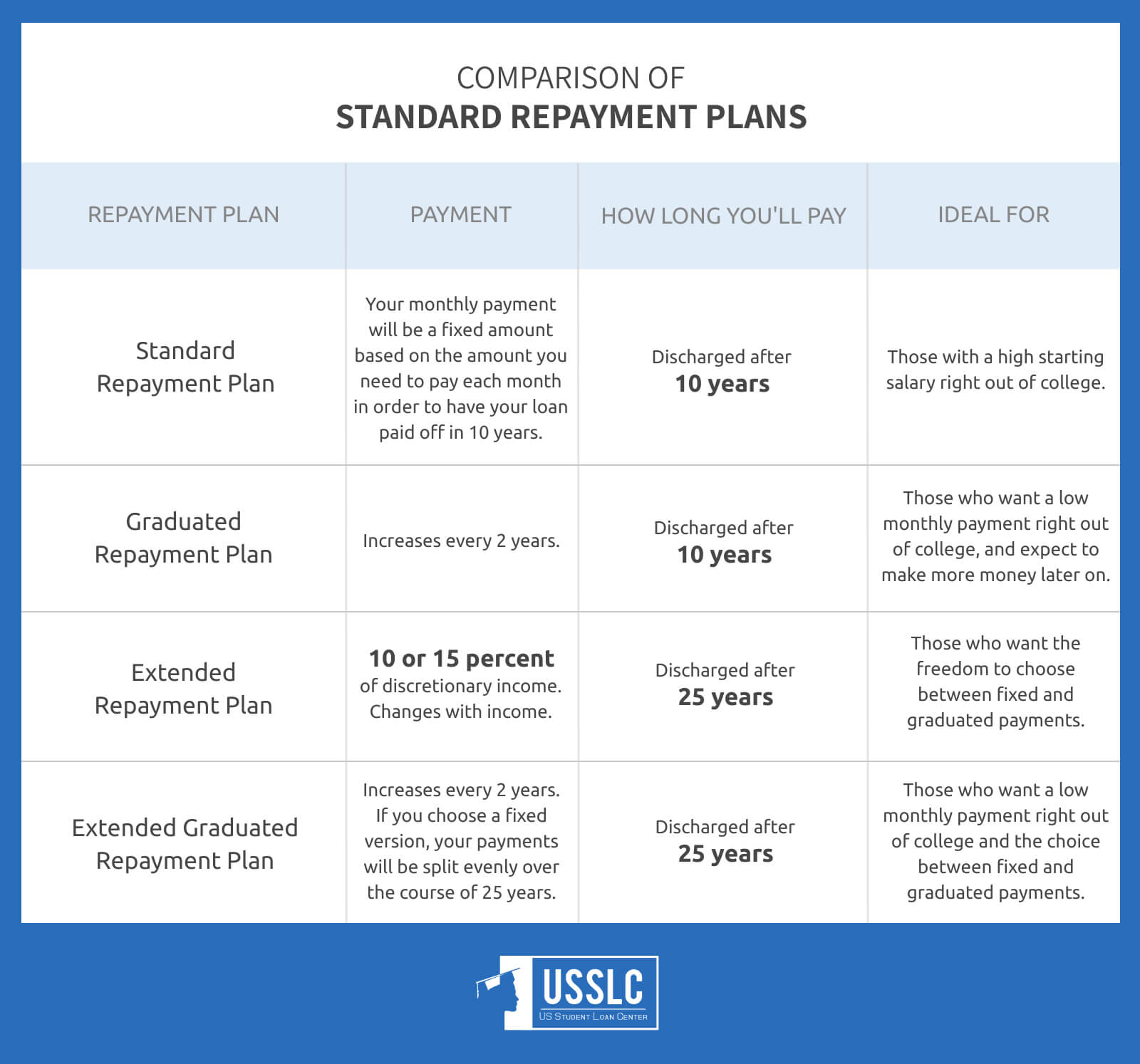

- Repayment Options: Explore various repayment plans, including standard, graduated, and income-driven plans, to find the one that aligns with your financial situation.

- Consolidation and Refinancing: Evaluate the pros and cons of consolidating multiple loans or refinancing to secure lower interest rates or better repayment terms.

- Loan Forgiveness Programs: Learn about programs like Public Service Loan Forgiveness and Teacher Loan Forgiveness, which offer loan cancellation for eligible borrowers.

- Credit Implications: Understand how student loans affect your credit score and consider strategies to manage your debt responsibly.

2024 UPDATED: Student Loan Repayment Plan Comparison - US Student Loan - Source usstudentloancenter.org

These aspects are interconnected and require careful consideration to make informed decisions about financing and repaying student loans. By staying informed and exploring the available options, students can navigate the complexities of financing higher education and optimize their repayment strategies.

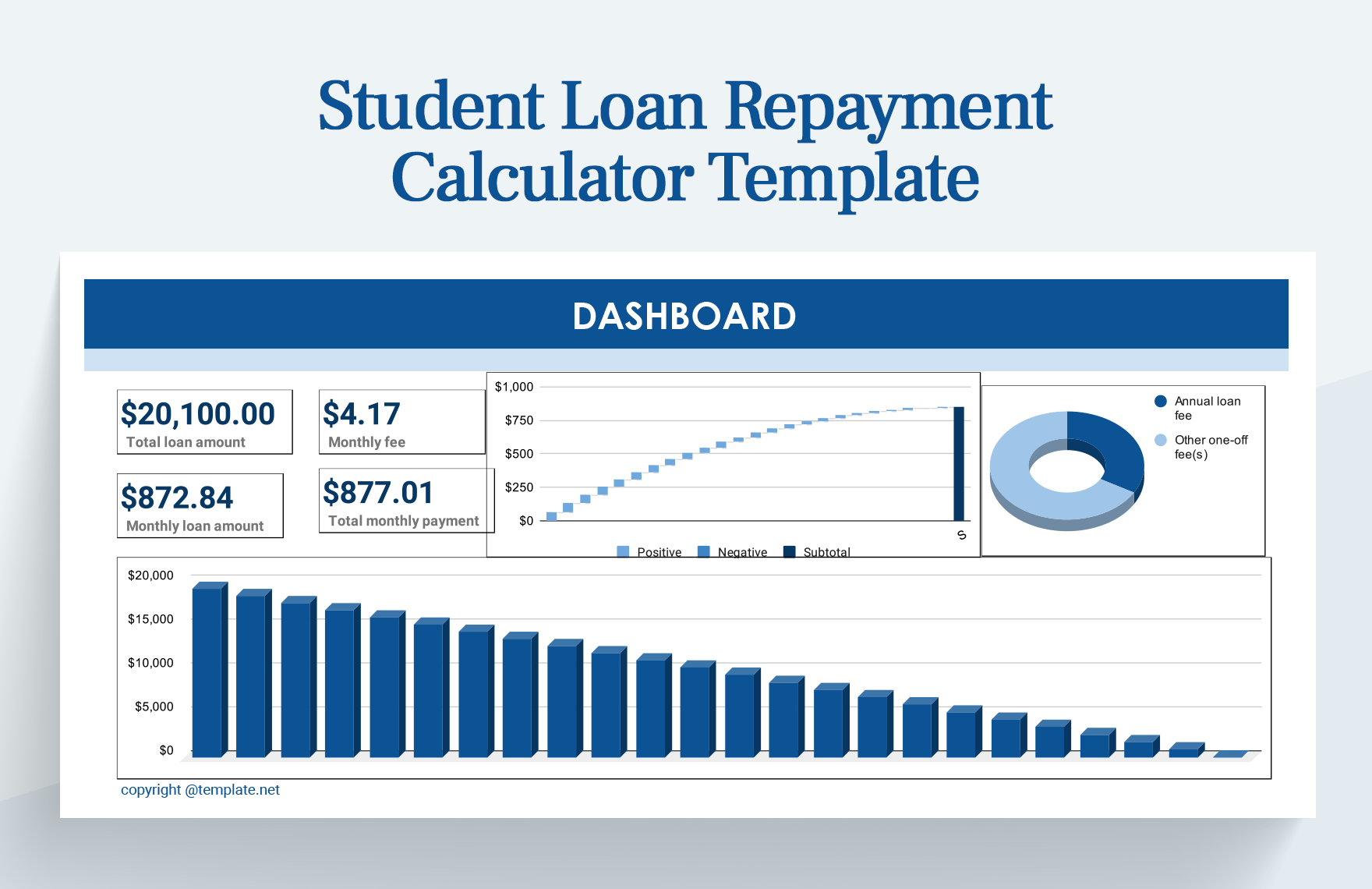

Student Loan Repayment Calculator Template in Excel, Google Sheets - Source www.template.net

Student Loans: Navigating Financing, Repayment, And Loan Forgiveness Options For Higher Education

The topic of student loans holds considerable importance within the framework of financing higher education. It delves into various aspects related to acquiring funds for educational pursuits, exploring repayment strategies, and examining loan forgiveness programs available to eligible individuals. Understanding these components empowers students to make informed decisions about financing their education, ensuring they can access the resources they need to pursue their academic goals.

F3E Online – Student Loan Forgiveness - Source f3eonline.org

The connection between financing, repayment, and loan forgiveness options is crucial in the context of student loans. The availability of financial aid allows individuals to cover the costs associated with higher education, which can often be substantial. However, the burden of student debt can weigh heavily on graduates, impacting their financial well-being and future aspirations. Repayment plans provide a structured approach to managing student loans, enabling borrowers to gradually pay off their debt over time. Loan forgiveness programs offer potential relief for borrowers who meet specific criteria, such as pursuing careers in public service or demonstrating financial hardship, providing a pathway to debt cancellation.

Comprehensively understanding the intricacies of student loans empowers individuals to navigate the financing, repayment, and loan forgiveness landscape effectively. This knowledge equips them with the tools necessary to make informed decisions, optimize their financial strategies, and achieve their educational goals. Recognizing the interconnectedness of these components ensures that individuals can access the resources they need to pursue higher education while mitigating the potential financial burden associated with student debt.

Conclusion

Exploring the topic of "Student Loans: Navigating Financing, Repayment, And Loan Forgiveness Options For Higher Education" underscores the critical role of understanding the interconnectedness of these aspects in ensuring accessible and sustainable higher education financing.

Empowering individuals with the knowledge and resources to navigate this complex landscape is essential to fostering economic mobility and reducing the financial barriers associated with pursuing higher education. By demystifying the processes of financing, repayment, and loan forgiveness, we can equip students with the tools they need to make informed decisions about their educational journeys and plan for a financially secure future.