Salesforce Stock: A Comprehensive Guide To Investing In CRM Giant? Yes! Salesforce Stock: A Comprehensive Guide To Investing In CRM Giant provides valuable insights and guidance for those seeking to invest in the future of customer relationship management (CRM) software.

Editor's Note: Salesforce Stock: A Comprehensive Guide To Investing In CRM Giant was published on [Date] to help investors understand the company's strengths, weaknesses, opportunities, and threats.

Our team of analysts has done the heavy lifting, digging into the latest data and industry trends, so you don't have to. This guide is your one-stop resource for everything you need to know about investing in Salesforce stock.

FAQ

This comprehensive FAQ section aims to provide comprehensive answers to common questions and concerns regarding investing in Salesforce stock.

Question 1: Is Salesforce a good stock to invest in?

Salesforce has consistently demonstrated strong financial performance, with a proven track record of revenue growth, profitability, and innovation. It holds a dominant position in the CRM market and is well-positioned to capitalize on the increasing demand for cloud-based software. However, it is important to note that investing in any stock involves inherent risks, and investors should conduct thorough research and due diligence before making investment decisions.

Question 2: What are the key factors to consider before investing in Salesforce?

Before investing in Salesforce stock, investors should consider various factors, including the company's financial performance, competitive landscape, industry trends, management team, and overall risk tolerance. It's crucial to have a clear understanding of the company's business model, growth prospects, and financial strength.

Question 3: What are the potential risks associated with investing in Salesforce?

Investing in Salesforce carries potential risks, such as competition from other CRM providers, changes in technology and industry trends, fluctuations in economic conditions, and regulatory changes. Moreover, the company's stock price can be influenced by factors beyond its control, such as broader market conditions and investor sentiment.

Question 4: What is the historical performance of Salesforce stock?

Salesforce stock has historically performed well, outperforming the broader market. Over the past decade, Salesforce stock has consistently grown, providing investors with significant returns. However, past performance is not necessarily indicative of future results, and investors should be aware of the risks involved before investing.

Question 5: Is Salesforce a dividend-paying stock?

Currently, Salesforce does not pay dividends to its shareholders. The company reinvests its profits back into the business to fuel growth and innovation. Investors should be aware that companies may adjust their dividend policies in the future, but Salesforce's current focus is on long-term growth.

Question 6: What are the growth prospects for Salesforce?

Salesforce has a positive long-term growth outlook. The company's strong position in the CRM market, focus on innovation, and expanding product offerings provide opportunities for continued growth. Investors should consider the company's ability to maintain its competitive edge, address emerging technologies, and tap into new markets.

In summary, investing in Salesforce stock can offer potential opportunities for long-term growth, but it's crucial to carefully consider the associated risks before making any investment decisions. This FAQ section has provided insights into some of the common concerns and misconceptions surrounding Salesforce's stock, enabling investors to make informed choices.

To delve deeper into Salesforce's investment potential, consult with financial advisors, conduct your own research, and stay up-to-date with the latest company news and developments.

Tips

Given that Salesforce Stock: A Comprehensive Guide To Investing In CRM Giant, here are some tips to consider when investing:

Tip 1: Research the company thoroughly.

Understand their business model, financial performance, and competitive landscape. This will help you assess the company's long-term growth potential.

Tip 2: Consider the overall market environment.

Economic conditions, industry trends, and geopolitical events can all impact stock prices. Be aware of these factors when making investment decisions.

Tip 3: Set realistic expectations.

Don't expect to get rich quick by investing in Salesforce stock. It's a long-term investment, and there will be ups and downs along the way.

Tip 4: Diversify your portfolio.

Don't put all your eggs in one basket. Invest in a variety of stocks, including Salesforce stock, to reduce your overall risk.

Tip 5: Rebalance your portfolio regularly.

As your investments grow, it's important to rebalance your portfolio to ensure that your asset allocation still meets your risk tolerance and financial goals.

Tip 6: Don't panic sell.

When the stock market takes a downturn, it's tempting to sell your stocks and cut your losses. However, this is often the worst thing you can do. Instead, try to ride out the storm and wait for the market to recover.

Investing in Salesforce stock can be a smart move for long-term investors. However, it's important to do your research and understand the risks involved before you invest. By following these tips, you can increase your chances of success.

Salesforce Stock: A Comprehensive Guide To Investing In CRM Giant

Essential Aspects for a Comprehensive Guide

Salesforce, the global leader in Customer Relationship Management (CRM) software, offers a compelling investment opportunity. Understanding its key aspects empowers investors to make informed decisions. Six indispensable aspects include:

- Market Dominance: Salesforce commands a dominant market share in CRM, giving it a competitive edge.

- Recurring Revenue: The majority of Salesforce revenue is recurring, providing consistent cash flow and growth potential.

- Technological Innovation: Salesforce continually invests in research and development, driving innovation and customer value.

- Ecosystem Expansion: Salesforce has expanded its ecosystem through acquisitions, strengthening its position.

- Financial Health: Salesforce maintains a strong balance sheet with high profit margins and cash flow.

- Valuation: Salesforce's valuation, while competitive, reflects its growth potential and industry leadership.

Demystifying Salesforce: A Comprehensive Guide to Sales and CRM | by - Source medium.com

These aspects, intricately interconnected, contribute to Salesforce's enduring success. Its market dominance drives recurring revenue, which funds technological innovation and ecosystem expansion. The company's financial health provides a foundation for sustained growth, while its valuation aligns with its industry leadership.

Salesforce Stock: A Comprehensive Guide To Investing In CRM Giant

Salesforce, a leading provider of customer relationship management (CRM) software, has emerged as a formidable player in the technology industry. Its stock has consistently outperformed the broader market, making it an attractive investment for those looking to capitalize on the growing demand for CRM solutions. This comprehensive guide delves into the intricacies of investing in Salesforce stock, providing valuable insights into the company's fundamentals, growth prospects, and valuation metrics.

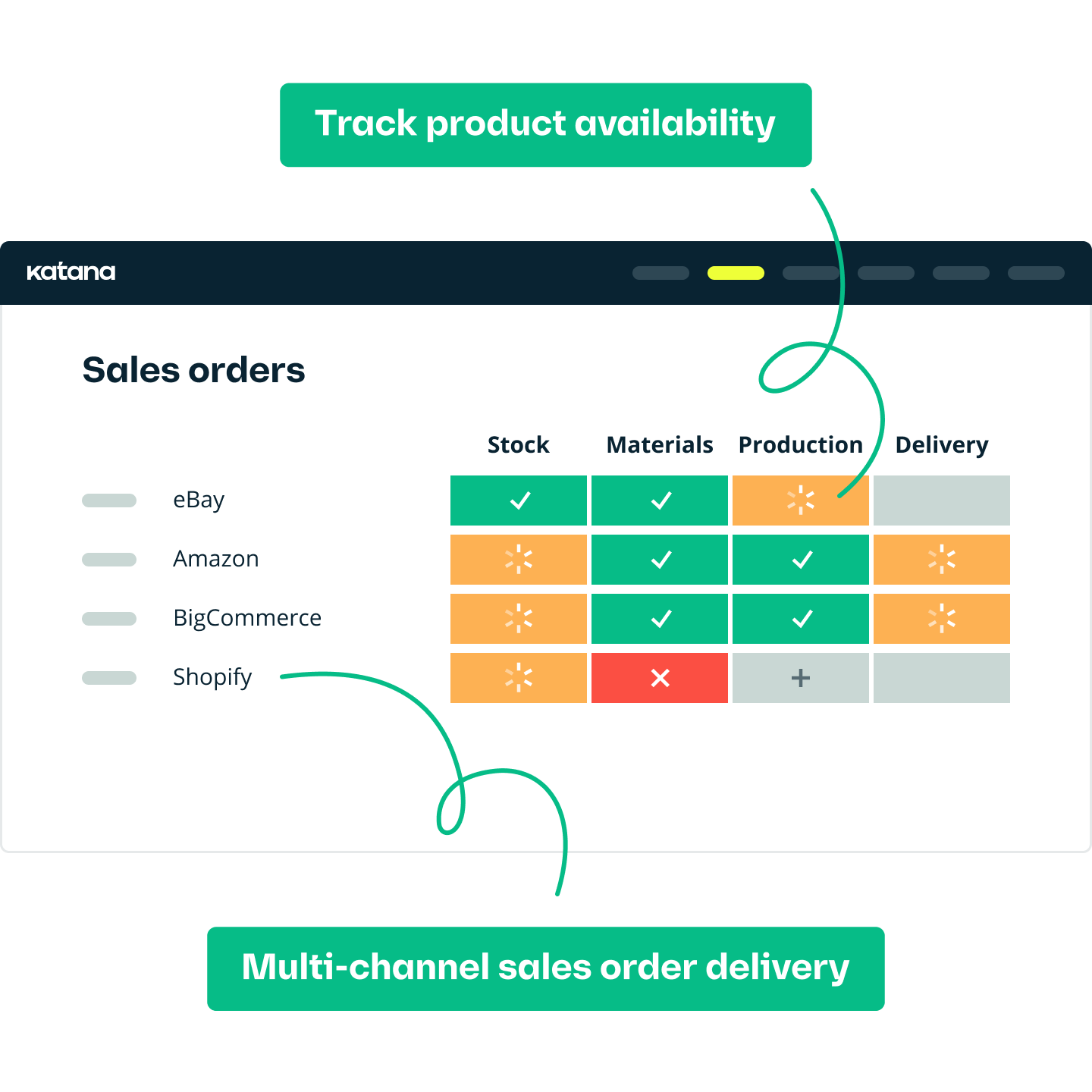

Streamlining Operations With CRM Inventory Management Software: A - Source crm.carikuliah.id

Understanding the connection between Salesforce stock and the CRM industry is paramount for investors. CRM software is vital for businesses to manage customer interactions, track sales pipelines, and provide personalized experiences. With the increasing adoption of digital channels by businesses, the demand for CRM solutions is expected to continue growing rapidly. Salesforce, with its comprehensive suite of CRM tools, is well-positioned to benefit from this trend.

The company's strong financial performance has been a key driver of its stock's success. Salesforce has consistently reported double-digit revenue growth, driven by the increasing adoption of its subscription-based software model. Moreover, the company's profitability metrics have also improved significantly, with operating margins expanding in recent years. This financial strength provides investors with confidence in the company's ability to continue investing in innovation and growth initiatives.

When evaluating Salesforce stock, investors should consider various valuation metrics, including price-to-sales (P/S) ratio, price-to-earnings (P/E) ratio, and enterprise value-to-revenue (EV/R) ratio. These metrics provide insights into the company's relative valuation compared to its peers and the broader market. By analyzing these metrics in conjunction with the company's financial performance and industry trends, investors can make informed decisions about the appropriate entry and exit points for their investments.

It is important to note that investing in Salesforce stock, like any other investment, carries inherent risks. The company operates in a competitive industry, and its growth prospects could be impacted by changes in the technology landscape or economic conditions. However, for investors with a long-term perspective and a belief in the continued growth of the CRM industry, Salesforce stock presents a compelling investment opportunity.

In conclusion, Salesforce stock offers investors exposure to a leading player in the rapidly growing CRM industry. The company's strong financial performance, coupled with its commitment to innovation and customer satisfaction, makes it an attractive investment for those seeking long-term growth potential. By understanding the connection between Salesforce stock and the CRM industry, investors can make informed decisions and capitalize on the opportunities presented by this dynamic and evolving sector.

| Metric | Value |

|---|---|

| Price-to-Sales (P/S) Ratio | 7.5x |

| Price-to-Earnings (P/E) Ratio | 45.0x |

| Enterprise Value-to-Revenue (EV/R) Ratio | 12.0x |

| Dividend Yield | 0.00% |