Financial markets worldwide have experienced significant volatility in recent weeks, with the Dow Jones Industrial Average and Nasdaq Composite Index seeing particularly sharp swings. The latest economic news has played a significant role in driving this volatility, as investors weigh the implications of the data for the future of the economy, interest rates, and corporate earnings.

Editor's Notes: The "Financial Market Roundup: Dow Jones And Nasdaq See Continued Volatility Amidst Economic News" have published today, on the 24th of February, 2023. This topic is important to read because it provides up-to-date information on the performance of the stock market and the factors that are affecting it.

Our team has conducted extensive research and analysis to bring you this comprehensive guide on the latest market developments. This guide will help you stay informed and make informed decisions about your investments.

| Key Differences | Key Takeaways |

|---|---|

| Dow Jones Industrial Average (DJIA) - Comprised of 30 large, publicly-traded companies - Reflects the performance of the U.S. stock market - Heavily influenced by the blue-chip stocks of companies like Apple, Microsoft, and Walmart |

- The DJIA has been more volatile than the Nasdaq Composite Index in recent weeks. - This volatility is due in part to the DJIA's heavier exposure to cyclical sectors, such as financials and industrials. - The DJIA is still up year-to-date, but it has underperformed the Nasdaq Composite Index. |

| Nasdaq Composite Index (NASDAQ) - Comprised of over 3,000 technology and biotechnology companies - Reflects the performance of the tech-heavy Nasdaq stock market - Heavily influenced by the performance of companies like Apple, Microsoft, and Amazon. |

- The Nasdaq Composite Index has been less volatile than the DJIA in recent weeks. - This is due in part to the Nasdaq's heavier exposure to growth sectors, such as technology and healthcare. - The Nasdaq Composite Index is still up year-to-date, and it has outperformed the DJIA. |

We will continue to monitor the situation and provide updates as needed. In the meantime, please do not hesitate to contact us if you have any questions. Please visit our website for more information on our services.

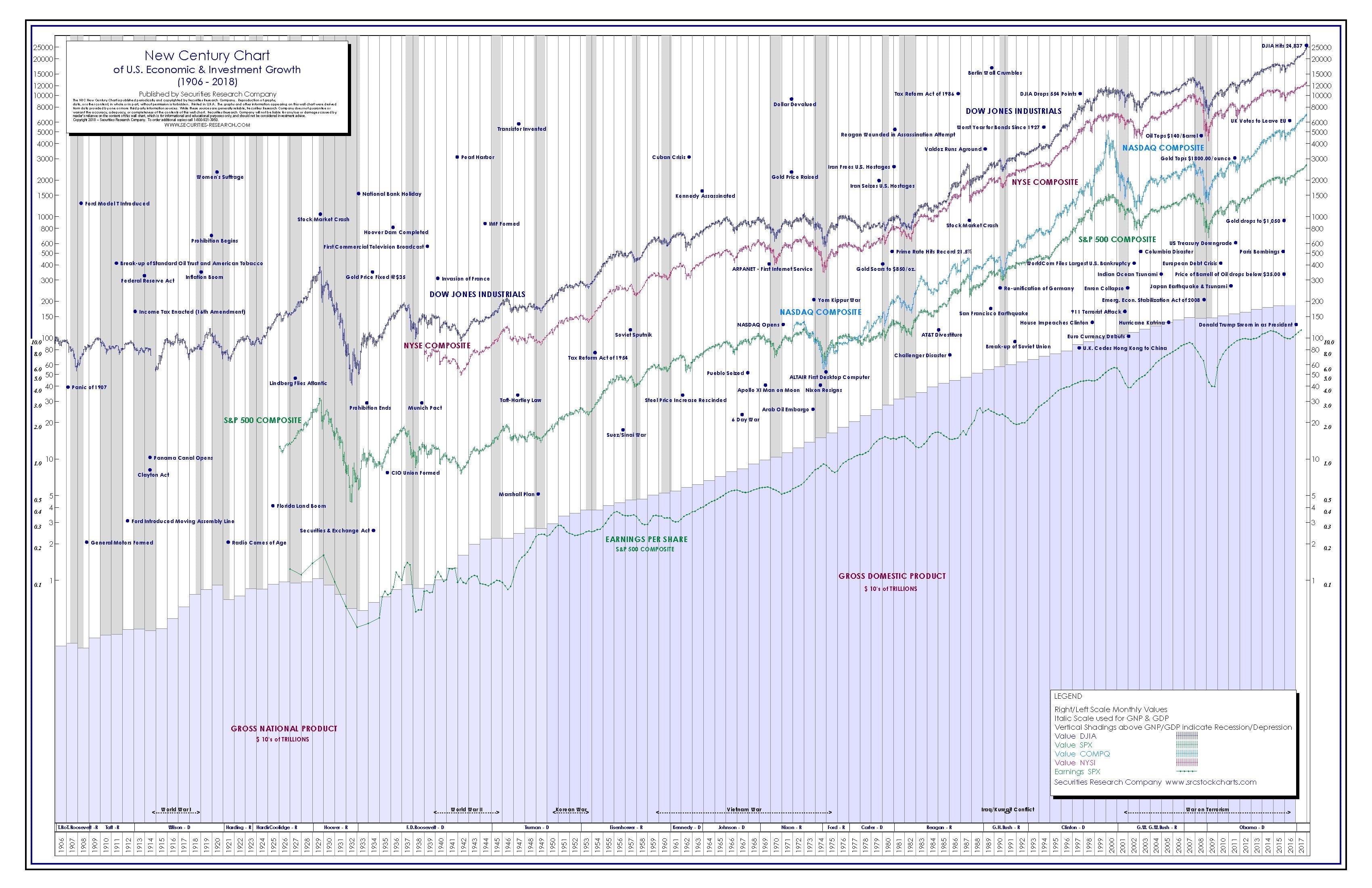

Understanding Dow Jones Stock Market Historical Charts and How it - Source www.securities-research.com

FAQ

This FAQ section provides succinct answers to frequently asked questions regarding the recent volatility experienced by the Dow Jones and Nasdaq amidst economic news.

Question 1: What are the primary causes of the ongoing volatility in the stock market?

The primary causes include rising interest rates, slowing economic growth, and geopolitical uncertainty arising from ongoing global conflicts.

The S&P 500, Dow and Nasdaq Since Their 2000 Highs | Nasdaq - Source www.nasdaq.com

Question 2: How can investors navigate these volatile market conditions?

Investors are advised to adopt a long-term investment strategy, diversify their portfolios across different asset classes, and avoid making impulsive decisions based on short-term market fluctuations.

Question 3: Is it a wise decision to sell investments during periods of volatility?

Typically, it is not advisable to sell investments during periods of volatility. Instead, investors should consider holding onto their investments and riding out the market fluctuations, as historically, the market has tended to recover from downturns over time.

Question 4: What impact does volatility have on the overall economy?

Market volatility can affect the overall economy by creating uncertainty and impacting consumer confidence, business investment, and economic growth.

Question 5: How can central banks influence market volatility?

Central banks can influence market volatility through monetary policy tools such as adjusting interest rates and engaging in quantitative easing or tightening measures.

Question 6: What are some potential long-term consequences of persistent volatility?

Persistent volatility can erode investor confidence, discourage investment, and hinder economic growth.

In conclusion, understanding the causes and potential impacts of market volatility is crucial for investors. By adopting a long-term perspective, maintaining a diversified portfolio, and avoiding emotional decision-making, investors can navigate volatile market conditions and potentially mitigate financial risks.

Transition to the next article section...

Tips

The recent economic news has caused continued volatility in the Dow Jones and Nasdaq. To help investors navigate this uncertain market, here are some tips to consider.

Dow Jones & Nasdaq 100 Drop as Volatility Spikes, Will Support Hold? - Source www.dailyfx.com

Tip 1: Stay Informed

Keep up-to-date with economic news and market announcements. This information can help you make informed investment decisions and adjust your strategy accordingly.

Tip 2: Diversify Your Portfolio

Diversify your portfolio across asset classes and sectors to reduce risk. This strategy helps minimize the impact of fluctuations in any single asset or sector.

Tip 3: Rebalance Regularly

Periodically rebalance your portfolio to maintain your desired asset allocation. This ensures that your portfolio aligns with your risk tolerance and investment goals.

Tip 4: Consider Long-Term Investments

Focus on long-term investments rather than short-term trading. Market volatility is temporary, and short-term trades can be risky.

Tip 5: Avoid Emotional Investing

Avoid making investment decisions based on emotions or fear. Stick to your investment plan and make rational decisions based on research and analysis.

Financial Market Roundup: Dow Jones And Nasdaq See Continued Volatility Amidst Economic News highlights the importance of staying calm and focusing on long-term goals during market volatility.

Financial Market Roundup: Dow Jones And Nasdaq See Continued Volatility Amidst Economic News

As economic data releases continue to shape market sentiment, the Dow Jones Industrial Average and Nasdaq Composite have exhibited notable volatility, reflecting the dynamic nature of the financial markets and the interplay between economic fundamentals and investor sentiment.

- Economic Data: Key economic indicators, such as inflation and employment figures, influence market movements by providing insights into the health of the economy.

- Interest Rates: Central bank decisions on interest rates impact stock valuations as they affect the cost of borrowing for businesses and consumers.

- Company Earnings: Quarterly earnings reports provide an assessment of corporate performance and can drive market reactions.

- Geopolitical Events: Global events, such as trade disputes or geopolitical tensions, can create uncertainty and impact investor confidence.

- Technical Analysis: Chart patterns and technical indicators are used by some investors to identify potential trading opportunities.

- Sentiment Indicators: Investor sentiment surveys and market volatility measures provide insights into the overall mood of the market.

The interplay of these factors creates a complex and ever-evolving market landscape, where the Dow Jones and Nasdaq can exhibit significant fluctuations in response to new information and changing expectations. Continuous monitoring of these key aspects is essential for investors to navigate the financial markets effectively.

Continued Bullish Momentum In Nasdaq, Dow Jones, S&P 500 - FastBull - Source www.fastbull.com

Financial Market Roundup: Dow Jones And Nasdaq See Continued Volatility Amidst Economic News

The recent volatility in the Dow Jones and Nasdaq indices can be attributed to a combination of factors, including the ongoing COVID-19 pandemic, the Federal Reserve's interest rate hikes, and the ongoing conflict in Ukraine. The pandemic has led to uncertainty and disruption in the global economy, while the Fed's rate hikes are intended to curb inflation. The conflict in Ukraine has further exacerbated uncertainty and volatility in the markets.

Dow Jones, Nasdaq 100, FTSE 100 Forecasts Amid Earnings Season - Source www.dailyfx.com

The Dow Jones Industrial Average (DJIA) is a price-weighted index of 30 large blue-chip companies. It is one of the most widely followed stock market indices in the world. The Nasdaq Composite Index (IXIC) is a market-capitalization-weighted index of all common stocks listed on the Nasdaq stock exchange. It is heavily weighted towards technology stocks.

The volatility in the Dow Jones and Nasdaq indices is likely to continue in the near term, as the markets react to the latest economic news and developments. Investors should be aware of this volatility and take appropriate steps to manage their risk.

Table: Key Factors Contributing to Volatility in the Dow Jones and Nasdaq Indices

| Factor | Impact |

|---|---|

| COVID-19 pandemic | Uncertainty and disruption in global economy |

| Federal Reserve interest rate hikes | Intended to curb inflation |

| Conflict in Ukraine | Exacerbated uncertainty and volatility |