DHS Deputizes IRS Agents: Unprecedented Expansion Of Power, what does this mean and how does this affect Americans?

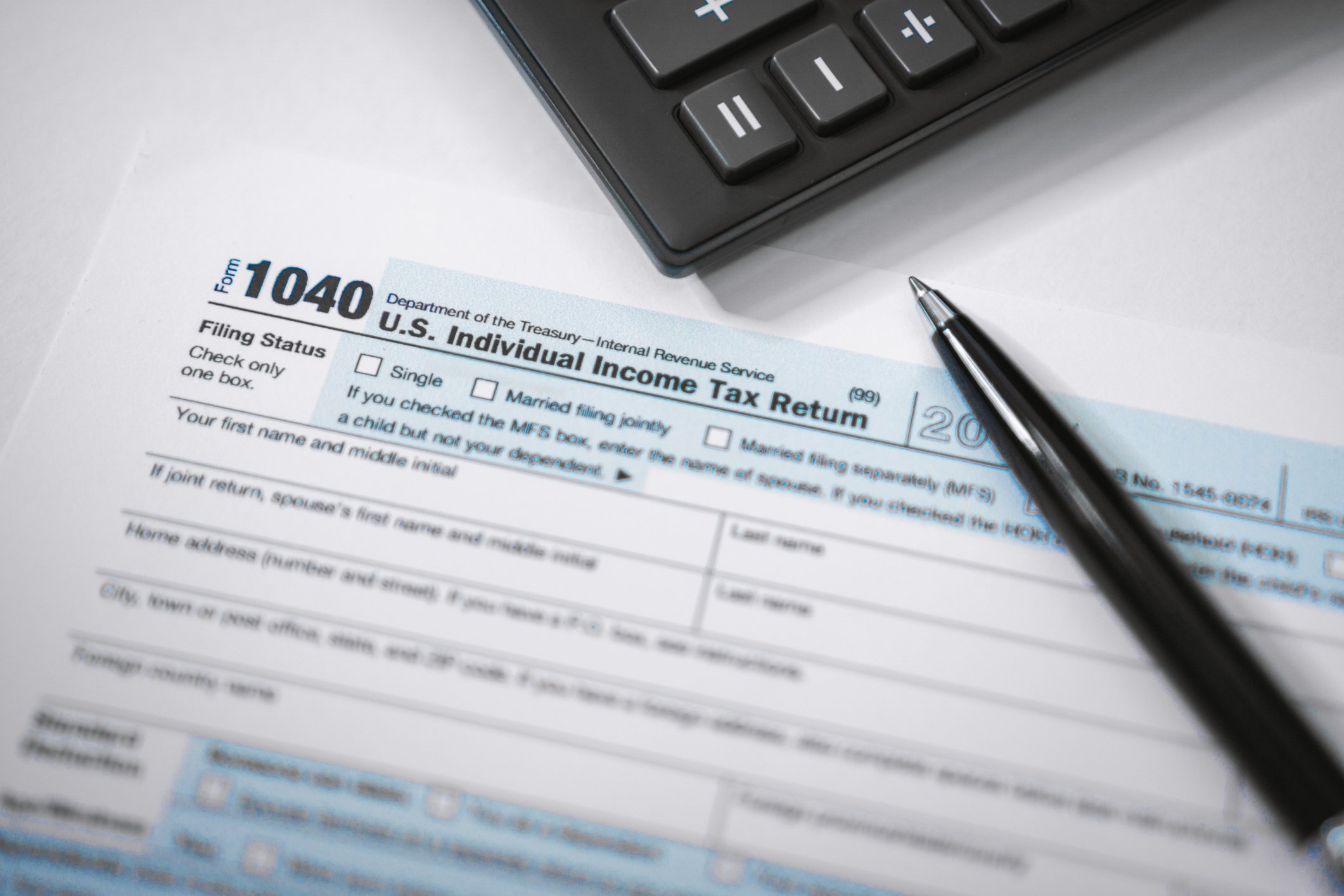

Editor's Notes: "DHS Deputizes IRS Agents: Unprecedented Expansion Of Power" have published today date. Anyone who follows the news knows that the Internal Revenue Service (IRS) is undergoing a major transformation. In recent months, the agency has hired thousands of new agents, and it has been given new powers to crack down on tax cheats. These changes have raised concerns among some Americans, who worry that the IRS is becoming too powerful.

To help you understand the issue, we've put together this "DHS Deputizes IRS Agents: Unprecedented Expansion Of Power" guide. In it, we'll explain what the changes mean, and we'll discuss the pros and cons of giving the IRS more power.

Key Differences

| Before | After | |

|---|---|---|

| Number of IRS agents | 78,000 | 87,000 |

| IRS budget | $12.6 billion | $13.6 billion |

| IRS enforcement authority | Limited | Expanded |

Main Article Topics

- What are the changes to the IRS?

- What are the pros and cons of giving the IRS more power?

- What can you do to protect yourself from IRS audits?

FAQ

This FAQ section addresses frequently asked questions and clarifies common misconceptions regarding the recent news of the DHS deputizing IRS agents. Our aim is to provide accurate information and dispel any uncertainties surrounding this development.

Unprecedented Views of Cell Interiors With New Expansion Microscopy Methods - Source tipmeacoffee.com

Question 1: What is the DHS's role in IRS enforcement?

The DHS has been granted temporary authority to assist the IRS in enforcing tax laws. This assistance is limited to specific circumstances and is intended to enhance the IRS's ability to combat financial crimes and tax evasion.

Question 2: Are IRS agents now armed?

No, IRS agents are not generally armed. However, the DHS has been authorized to provide limited protective services to IRS employees who may face potential threats while performing their duties.

Question 3: Will the DHS have access to taxpayer information?

The DHS will have access to taxpayer information to the extent necessary to assist the IRS in its enforcement efforts. This access is subject to strict controls and safeguards to protect taxpayer privacy.

Question 4: Is this expansion of power a threat to civil liberties?

The DHS's involvement in IRS enforcement is being closely monitored to ensure that it does not infringe upon taxpayer rights. The IRS has emphasized that its focus remains on high-end tax evaders and that ordinary taxpayers will not be affected.

Question 5: What should taxpayers do in response to this development?

Taxpayers should continue to comply with their tax obligations as they normally would. If they have any concerns or questions, they should contact the IRS directly.

Question 6: Is this expansion of power necessary?

The decision to deputize IRS agents has been made in response to concerns about the growing sophistication and scale of financial crimes. The DHS's assistance is intended to strengthen the IRS's efforts to combat these crimes and protect the integrity of the tax system.

In summary, the DHS's deputization of IRS agents is a targeted measure aimed at enhancing tax enforcement and combating financial crimes. It is important to note that this expansion of power is subject to safeguards and controls to protect taxpayer privacy and rights.

For more information and updates, please refer to the official websites of the DHS and the IRS.

Tips

The DHS Deputizes IRS Agents: Unprecedented Expansion Of Power measure has raised concerns among privacy advocates and taxpayers alike. Here are some tips to consider in the wake of this development:

Tip 1: Understand the new powers of the IRS

The new law gives the IRS the authority to deputize agents from the Department of Homeland Security (DHS) to carry out its enforcement duties. This means that DHS agents could be involved in investigating and pursuing tax fraud cases. It's important to be aware of this potential expansion of the IRS's reach.

Tip 2: Be cautious about what you say and do

With the increased scrutiny that the IRS may have, it's more important than ever to be careful about what you say and do. Avoid making any false or misleading statements to the IRS, and be prepared to provide documentation to support your claims. If you're not sure whether something is legal, consult with a tax professional.

Tip 3: Keep good records

In the event of an audit, it's crucial to have good records to support your tax return. This includes receipts, bank statements, and other documents that can prove your income, deductions, and credits. Organizing your records will make it easier to respond to any questions the IRS may have.

Tip 4: Be prepared to cooperate with the IRS

If you're contacted by the IRS, be cooperative and provide any information they request. However, you don't have to answer questions if you don't feel comfortable doing so. You can always consult with a tax professional before responding to any IRS inquiries.

Tip 5: Don't panic

If you're audited, don't panic. The IRS is simply trying to verify the accuracy of your tax return. By following these tips, you can help to make the audit process as smooth and painless as possible.

Summary

The expansion of the IRS's powers is a significant development that could have a major impact on taxpayers. By following these tips, you can help to protect yourself and your financial information.

DHS Deputizes IRS Agents: Unprecedented Expansion Of Power

The Department of Homeland Security (DHS) deputizing IRS agents marks an unprecedented expansion of power, raising concerns about the potential for increased surveillance, intimidation, and abuse. Six key aspects emerge from this move:

These aspects highlight the complex and concerning implications of DHS deputizing IRS agents. The expansion of surveillance capabilities, the potential for intimidation and abuse, the erosion of privacy, the harm to taxpayer confidence, and the challenge to separation of powers warrant careful consideration and oversight.

IRS Announces Expansion of Identity Protection to Taxpayers - Source adamlevin.com

'Unprecedented' Amount of Illegal Marijuana Seized by Border Agents - Source www.newsweek.com

DHS Deputizes IRS Agents: Unprecedented Expansion Of Power

The Department of Homeland Security (DHS) has deputized IRS agents, giving them the authority to carry firearms and make arrests. This is an unprecedented expansion of power for the IRS, which has traditionally been responsible for collecting taxes. The move has raised concerns among some lawmakers and civil liberties groups, who worry that it could lead to the IRS being used to target political opponents or harass taxpayers.

New Trump Plan Deputizes Cops as ICE Agents, Even in Sanctuary Cities - Source truthout.org

The DHS says that the deputization is necessary to protect IRS agents from violence and to help them enforce the tax laws. However, critics argue that the move is unnecessary and that it could lead to the IRS becoming a more powerful and intimidating agency. Only time will tell how the deputization of IRS agents will affect the agency's operations and the relationship between the IRS and the American people.

The deputization of IRS agents is a significant development with the potential to have a major impact on the agency's operations and the relationship between the IRS and the American people. It is important to understand the causes and effects of this decision, as well as its potential implications.

Cause and Effect

- Cause: The DHS deputizes IRS agents to protect them from violence and to help them enforce the tax laws.

- Effect: The IRS becomes a more powerful and intimidating agency.

Importance

- The deputization of IRS agents is a significant development with the potential to have a major impact on the agency's operations and the relationship between the IRS and the American people.

- It is important to understand the causes and effects of this decision, as well as its potential implications.

Conclusion

The deputization of IRS agents is a controversial decision with the potential to have a significant impact on the agency's operations and the relationship between the IRS and the American people. It is important to continue to monitor this development and to hold the IRS accountable for its actions.

The future of the IRS is uncertain. The agency is facing a number of challenges, including declining revenues, increasing complexity of the tax code, and a growing backlog of cases. The deputization of IRS agents could make these challenges even more difficult to overcome. However, it is also possible that the deputization will help the IRS to become a more effective and efficient agency.