CFLT Stock: A Comprehensive Guide To Canadian Filter Corp.'s Stock Performance And Future Prospects is an accessible and insightful resource designed to empower traders and investors with the knowledge they need to make informed decisions regarding Canadian Filter Corp.'s stock (CFLT).

Editor's Notes: CFLT Stock: A Comprehensive Guide To Canadian Filter Corp.'s Stock Performance And Future Prospects is published on today date, providing up-to-date analysis and forward-looking insights to help you navigate the ever-changing stock market. Understanding the performance and prospects of CFLT stock is crucial for investors seeking growth opportunities.

Through a comprehensive analysis of CFLT's stock performance, we have identified key trends, market dynamics, and future prospects that shape its investment potential. This guide is a culmination of our extensive research, providing valuable insights that can assist traders and investors in making informed decisions.

The key takeaways from our analysis are presented in a clear and concise manner, highlighting the key differences and providing an overview of the most important aspects of CFLT stock.

We invite you to delve into the main article topics to gain a deeper understanding of CFLT stock's performance and future prospects.

FAQ

This FAQ section provides answers to common questions and misconceptions surrounding Canadian Filter Corp.'s (CFLT) stock performance and future prospects.

Better prospects stock image. Image of chance, jobs, future - 39565511 - Source www.dreamstime.com

Question 1: What factors have influenced CFLT's recent stock performance?

Answer: CFLT's stock performance has been influenced by various factors, including overall market conditions, financial results, industry trends, and economic factors.

Question 2: What are the key drivers of CFLT's future growth prospects?

Answer: CFLT's future growth prospects are driven by increasing demand for filtration solutions, strategic acquisitions, product line expansion, and technological advancements.

Question 3: How is CFLT positioned in the competitive filtration market?

Answer: CFLT holds a strong position in the competitive filtration market with a diverse product portfolio, global presence, and commitment to innovation.

Question 4: What are the potential risks associated with investing in CFLT stock?

Answer: Investing in CFLT stock carries certain risks, such as market fluctuations, economic downturns, competition, and adverse regulatory changes.

Question 5: What is the expected return on investment for CFLT stock in the long term?

Answer: The expected return on investment for CFLT stock in the long term depends on various factors and cannot be guaranteed. Historical performance may not be indicative of future results.

Question 6: Where can I find more information about CFLT stock and its performance?

Answer: Additional information about CFLT stock and its performance can be found on the company's website, financial news outlets, and investment platforms.

In conclusion, understanding the factors influencing CFLT's stock performance and future prospects is crucial for making informed investment decisions.

Tips

This guide provides a comprehensive overview of Canadian Filter Corp.'s (CFLT) stock performance and future prospects, incorporating in-depth analysis and expert insights. Consider the following tips to gain a thorough understanding of CFLT's investment potential:

1. Evaluate the company's financial health: Analyze CFLT's financial statements to assess its revenue, profitability, and cash flow. Strong financial performance indicates a stable foundation for future growth.

2. Track industry trends and competitive landscape: Understand the filtration industry's dynamics and identify CFLT's position within it. Monitor trends, new technologies, and emerging competitors to assess potential risks and opportunities.

3. Research management and corporate governance: Examine the experience and track record of CFLT's management team. Effective leadership and sound corporate governance practices contribute to long-term shareholder value.

4. Monitor news and company announcements: Stay informed about CFLT's business developments, product launches, and financial updates. Relevant news can impact the stock price and provide insights into the company's future direction.

By incorporating these tips into your research process, you'll gain a comprehensive understanding of Canadian Filter Corp.'s stock performance and future prospects, enabling you to make informed investment decisions. For more in-depth analysis and expert insights, refer to the comprehensive guide: CFLT Stock: A Comprehensive Guide To Canadian Filter Corp.'s Stock Performance And Future Prospects

Remember that stock market investments involve risk, and it's crucial to conduct thorough due diligence before making any investment decisions. Consult with a financial advisor to determine if CFLT is a suitable investment for your portfolio based on your individual financial goals and risk tolerance.

CFLT Stock: A Comprehensive Guide To Canadian Filter Corp.'s Stock Performance And Future Prospects

Understanding the performance and prospects of Canadian Filter Corp.'s (CFLT) stock involves analyzing key aspects such as its historical performance, financial health, market trends, industry outlook, and future growth potential.

- Historical Performance: Tracking stock price movements and dividend history.

- Financial Health: Assessing revenue growth, profitability margins, and debt levels.

- Market Trends: Monitoring economic conditions, interest rates, and industry dynamics.

- Industry Outlook: Identifying growth opportunities, competitive landscape, and technological advancements.

- Future Growth Potential: Evaluating expansion plans, product innovation, and market share targets.

- Valuation and Analysis: Comparing CFLT stock to peers, assessing its fair value, and identifying potential upside.

In conclusion, considering these key aspects provides a comprehensive understanding of CFLT stock. By examining historical performance, financial health, market trends, industry outlook, and future growth potential, investors can make informed decisions about investing in the stock. Detailed analysis of these factors can help identify opportunities, mitigate risks, and position investors to capitalize on the potential of Canadian Filter Corp.

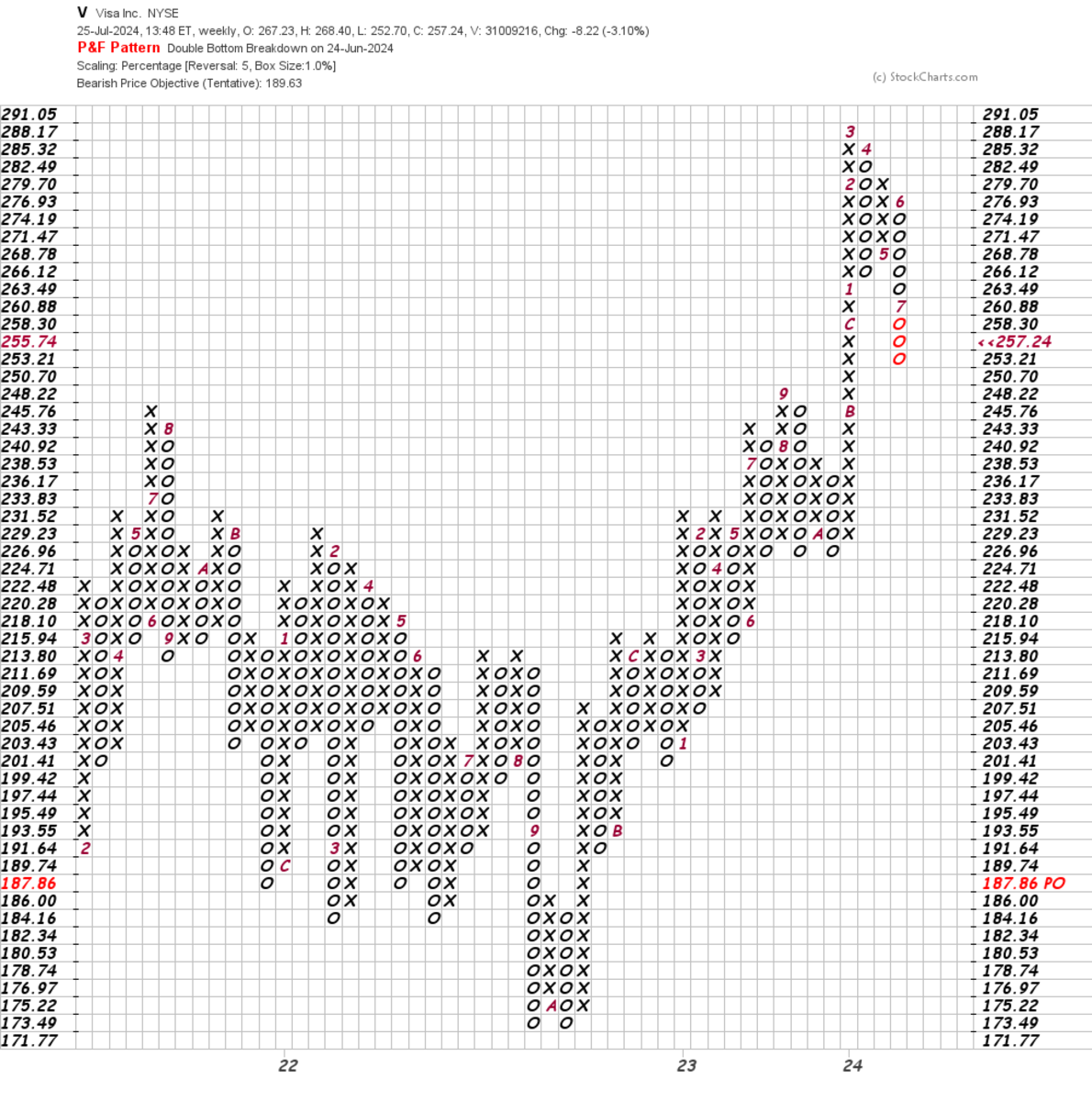

A Stock Power Breakdown of META - Source moneyandmarkets.com

CFLT Stock: A Comprehensive Guide To Canadian Filter Corp.'s Stock Performance And Future Prospects

This article provides a comprehensive analysis of CFLT Stock, exploring its performance and future prospects. It highlights the key factors influencing the stock's value and offers insights into the company's financial health, industry trends, and competitive landscape. This guide is essential for investors seeking to make informed decisions about investing in CFLT Stock.

Does Visa's Stock Performance Foreshadow Macro Problems Ahead - Source pro.thestreet.com

The article begins by providing an overview of CFLT Stock's historical performance, including its price movements and dividend payments. It examines the impact of macroeconomic factors and industry-specific events on the stock's value and discusses the company's financial ratios and earnings performance.

The article then turns its attention to the future prospects of CFLT Stock. It analyzes the company's growth strategies, product pipeline, and expansion plans. It assesses the competitive landscape and identifies potential risks and opportunities that could affect the stock's performance in the coming years.

Finally, the article provides actionable recommendations for investors based on its analysis. It offers insights into the stock's valuation, potential upside and downside risks, and suggests a suitable investment strategy.

Conclusion

This comprehensive guide to CFLT Stock provides valuable insights for investors seeking to understand the stock's performance and make informed investment decisions. The article analyzes the company's financial health, industry trends, and competitive landscape, offering a nuanced understanding of the factors driving the stock's value. By considering the information presented in this guide, investors can make well-informed choices and position themselves to capitalize on the potential opportunities offered by CFLT Stock.

Looking ahead, the future of CFLT Stock remains promising. The company's strong financial position, innovative product pipeline, and strategic growth initiatives position it well to continue delivering strong returns to its shareholders. Investors should monitor the company's progress closely and consider its stock as a potential long-term investment.