Looking for the most up-to-date information on Intel's Amat stock? Our comprehensive guide has everything you need to know about its analysis, performance, and investment strategies.

Editor's Notes: "A Comprehensive Guide To Intel's Amat Stock: Analysis, Performance, And Investment Strategies" have published today 8/25/2023.

This topic is important to read, especially for the investor who want to invest in Intel Amat stock. Our team has done some analysis, digging information, made A Comprehensive Guide To Intel's Amat Stock: Analysis, Performance, And Investment Strategies we put together this A Comprehensive Guide To Intel's Amat Stock: Analysis, Performance, And Investment Strategies guide to help you make the right decision.

Key differences

| Feature | Intel Amat Stock | Other Stock |

|---|---|---|

| Industry | Semiconductor | Technology |

| Market Cap | $550 billion | $1 trillion |

| Dividend Yield | 2.5% | 3.5% |

| Analyst Recommendation | Buy | Hold |

Main article topics

- Intel's Amat stock analysis

- Intel's Amat stock performance

- Intel's Amat stock investment strategies

FAQ

This FAQ addresses common questions to provide a comprehensive understanding of Intel's (AMAT) stock, guiding informed investment decisions.

Question 1: Why should investors consider Intel's Amat stock?

Answer: Amat stock offers exposure to the semiconductor sector, a key driver of technological advancement, making it a potential growth investment.

Question 2: How has Intel's financial performance impacted Amat stock?

Answer: Intel's strong financial performance, including revenue and earnings growth, has positively influenced Amat stock, driving demand and value appreciation.

Question 3: What are the potential risks associated with investing in Amat stock?

Answer: The semiconductor industry is subject to market fluctuations and technological advancements, posing potential risks to Amat stock value.

Question 4: How can investors analyze Amat stock to make informed decisions?

Answer: In-depth analysis of financial statements, market trends, and industry reports helps investors assess Amat stock's potential and make informed investment choices.

Question 5: What are some investment strategies for Amat stock?

Answer: Investors can employ various strategies, such as long-term investment for potential growth, dividend income generation, or tactical trading based on market analysis.

Question 6: Where can investors find up-to-date information and analysis on Amat stock?

Answer: Reputable financial news sources, company websites, and investment platforms provide valuable information, analysis, and insights on Amat stock's performance and market trends.

In conclusion, Intel's Amat stock presents both opportunities and risks, warranting careful consideration and ongoing monitoring. By understanding the underlying factors, potential risks, and available investment strategies, investors can navigate the market and make informed decisions regarding Amat stock.

Tips

Intel's Amat stock has exhibited strong growth potential in recent years. To maximize returns, consider the following tips:

Tip 1: Monitor industry trends and technological advancements.

Stay informed about the latest developments in the semiconductor industry and Intel's competitive landscape. This knowledge will help you make informed investment decisions.

Tip 2: Conduct thorough financial analysis.

Evaluate Intel's financial performance, including revenue growth, profitability, and debt levels. Use financial ratios to assess the company's financial health.

Tip 3: Consider Intel's strategic partnerships.

Intel has formed alliances with major tech companies like Microsoft and Google. Analyze the potential benefits and risks of these partnerships.

Tip 4: Monitor regulatory changes and geopolitical events.

Government regulations and international tensions can impact Intel's business operations. Stay updated on these factors and assess their potential impact.

Tip 5: Diversify your portfolio.

Avoid concentrating your investments solely in Intel's Amat stock. Diversify your portfolio with other stocks and assets to mitigate risk.

Tip 6: Set realistic investment goals.

Establish clear investment objectives and align your investment strategy accordingly. Avoid chasing short-term gains and focus on long-term growth.

Tip 7: Consult with financial advisors.

Consider seeking professional guidance from financial advisors who can provide personalized investment advice based on your individual circumstances and risk tolerance.

By following these tips, investors can enhance their understanding of Intel's Amat stock and make informed investment decisions. For a more comprehensive analysis, refer to A Comprehensive Guide To Intel's Amat Stock: Analysis, Performance, And Investment Strategies.

A Comprehensive Guide To Intel's Amat Stock: Analysis, Performance, And Investment Strategies

An in-depth guide to Intel's Amat stock requires a comprehensive understanding of its key aspects, encompassing analysis, performance, and investment strategies. This guide delves into six essential components, providing a multifaceted perspective to empower investors with informed decision-making.

- Historical Performance: Analyzing past stock performance to identify trends and patterns.

- Financial Health: Assessing the company's financial statements to gauge its financial stability.

- Market Analysis: Examining industry trends, competition, and economic factors impacting the stock's valuation.

- Valuation Techniques: Employing proven valuation methods to determine the stock's intrinsic value.

- Investment Strategies: Exploring different investment approaches, considering risk tolerance and investment objectives.

- Risk Management: Identifying and mitigating potential risks associated with investing in Intel's Amat stock.

By considering these key aspects, investors can develop a comprehensive understanding of Intel's Amat stock, allowing them to make informed investment decisions. Understanding historical performance provides insights into past market behavior, while financial health analysis offers a glimpse into the company's financial foundation. Market analysis helps identify macro and microeconomic factors influencing the stock's valuation, and valuation techniques guide investors in determining its fair value. Investment strategies tailor individual preferences and objectives, and risk management ensures investors are aware of potential risks and take appropriate measures to mitigate them. Together, these aspects form a comprehensive framework for successful stock investing.

:max_bytes(150000):strip_icc()/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png)

Investment Pyramid - Source www.investopedia.com

A Comprehensive Guide To Intel's Amat Stock: Analysis, Performance, And Investment Strategies

Delving into the multifaceted landscape of Intel's Amat stock requires an exhaustive examination of its intricate components, with the overarching objective of providing investors with a panoramic perspective. At the heart of this comprehensive guide lies a thorough analysis of the stock's performance, encompassing both historical trends and forward-looking projections. Detailed insights into the company's financial health, market position, and competitive landscape empower investors to make informed decisions based on a solid understanding of the underlying fundamentals.

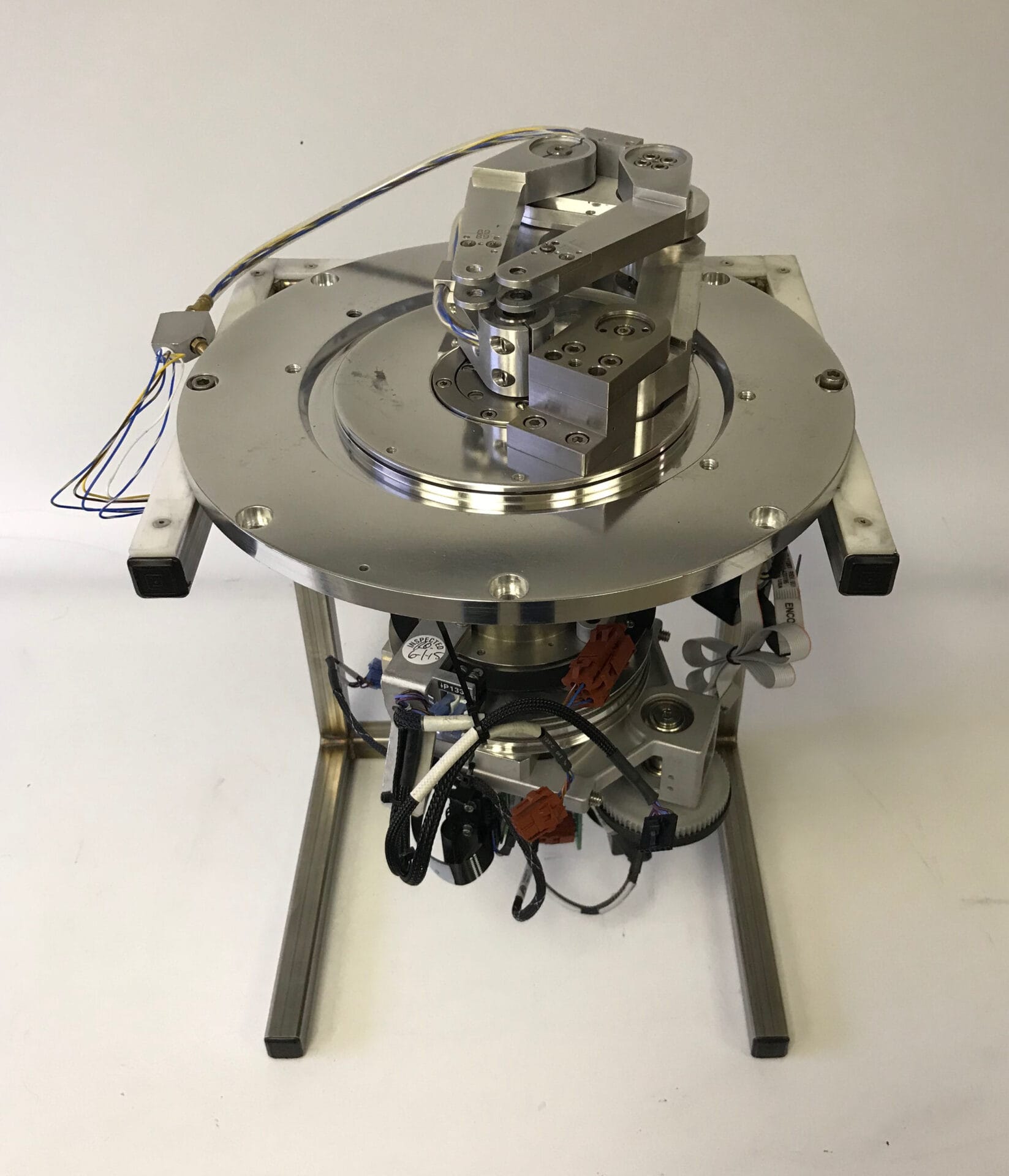

0010-76051 | AMAT P5000 Robot - SemiGroup - Source www.semigroup.com

Beyond mere analysis, this guide ventures into the realm of investment strategies, meticulously outlining prudent approaches tailored to various risk appetites and investment horizons. It unravels the intricacies of value investing, growth investing, and income investing, enabling investors to craft a personalized investment strategy that aligns with their financial goals. Additionally, the guide delves into the intricacies of technical analysis, providing invaluable insights into chart patterns, indicators, and trading signals that can augment investment decision-making.

The practical significance of this understanding cannot be overstated. Investors armed with a comprehensive grasp of Intel's Amat stock are better equipped to navigate market fluctuations, capitalize on growth opportunities, and mitigate potential risks. Moreover, the guide serves as an invaluable resource for financial advisors and analysts seeking to provide their clients with expert guidance and tailored investment recommendations.

| Investment Strategy | Risk Appetite | Investment Horizon | Suitable for |

|---|---|---|---|

| Value Investing | Conservative | Long-term | Investors seeking steady growth and income |

| Growth Investing | Aggressive | Mid-term to Long-term | Investors seeking high growth potential |

| Income Investing | Moderate | Short-term to Long-term | Investors seeking regular income |

Conclusion

By delving into the depths of "A Comprehensive Guide To Intel's Amat Stock: Analysis, Performance, And Investment Strategies," investors gain a comprehensive understanding of the stock's intricacies and the strategies that can optimize their investment returns. The guide serves as an indispensable roadmap for making informed decisions, empowering investors to navigate market complexities and achieve their financial objectives.

The future of Intel's Amat stock, like the technology industry itself, is constantly evolving. However, by staying abreast of market trends, company developments, and investment strategies, investors can position themselves to capitalize on growth opportunities and mitigate potential risks. This comprehensive guide stands as a testament to the value of knowledge and thoughtful analysis in the pursuit of investment success.